Target 2012 Annual Report Download - page 42

Download and view the complete annual report

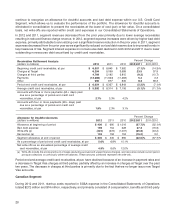

Please find page 42 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(e) Estimated tax contingencies of $280 million, including interest and penalties, are not included in the table above because we are not able to

make reasonably reliable estimates of the period of cash settlement. See Note 23 of the Notes to Consolidated Financial Statements for

further information.

(f) Real estate obligations include commitments for the purchase, construction or remodeling of real estate and facilities.

(g) Purchase obligations include all legally binding contracts such as firm minimum commitments for inventory purchases, merchandise

royalties, equipment purchases, marketing-related contracts, software acquisition/license commitments and service contracts. We issue

inventory purchase orders in the normal course of business, which represent authorizations to purchase that are cancelable by their terms.

We do not consider purchase orders to be firm inventory commitments; therefore, they are excluded from the table above. If we choose to

cancel a purchase order, we may be obligated to reimburse the vendor for unrecoverable outlays incurred prior to cancellation. We also

issue trade letters of credit in the ordinary course of business, which are excluded from this table as these obligations are conditioned on

terms of the letter of credit being met.

(h) We have not included obligations under our pension and postretirement health care benefit plans in the contractual obligations table above

because no additional amounts are required to be funded as of February 2, 2013. Our historical practice regarding these plans has been to

contribute amounts necessary to satisfy minimum pension funding requirements, plus periodic discretionary amounts determined to be

appropriate.

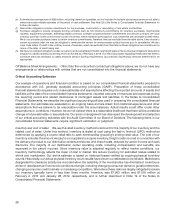

Off Balance Sheet Arrangements: Other than the unrecorded contractual obligations above, we do not have any

arrangements or relationships with entities that are not consolidated into the financial statements.

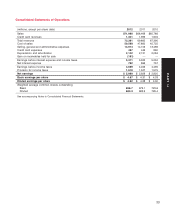

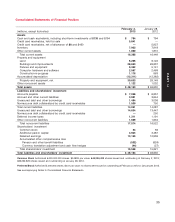

Critical Accounting Estimates

Our analysis of operations and financial condition is based on our consolidated financial statements prepared in

accordance with U.S. generally accepted accounting principles (GAAP). Preparation of these consolidated

financial statements requires us to make estimates and assumptions affecting the reported amounts of assets and

liabilities at the date of the consolidated financial statements, reported amounts of revenues and expenses during

the reporting period and related disclosures of contingent assets and liabilities. In the Notes to Consolidated

Financial Statements, we describe the significant accounting policies used in preparing the consolidated financial

statements. Our estimates are evaluated on an ongoing basis and are drawn from historical experience and other

assumptions that we believe to be reasonable under the circumstances. Actual results could differ under other

assumptions or conditions. However, we do not believe there is a reasonable likelihood that there will be a material

change in future estimates or assumptions. Our senior management has discussed the development and selection

of our critical accounting estimates with the Audit Committee of our Board of Directors. The following items in our

consolidated financial statements require significant estimation or judgment:

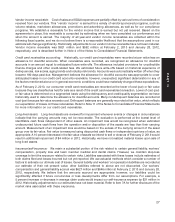

Inventory and cost of sales: We use the retail inventory method to account for the majority of our inventory and the

related cost of sales. Under this method, inventory is stated at cost using the last-in, first-out (LIFO) method as

determined by applying a cost-to-retail ratio to each merchandise grouping’s ending retail value. The cost of our

inventory includes the amount we pay to our suppliers to acquire inventory, freight costs incurred in connection with

the delivery of product to our distribution centers and stores, and import costs, reduced by vendor income and cash

discounts. The majority of our distribution center operating costs, including compensation and benefits, are

expensed in the period incurred. Since inventory value is adjusted regularly to reflect market conditions, our

inventory methodology reflects the lower of cost or market. We reduce inventory for estimated losses related to

shrink and markdowns. Our shrink estimate is based on historical losses verified by ongoing physical inventory

counts. Historically, our actual physical inventory count results have shown our estimates to be reliable. Markdowns

designated for clearance activity are recorded when the salability of the merchandise has diminished. Inventory is

at risk of obsolescence if economic conditions change, including changing consumer demand, guest preferences,

changing consumer credit markets or increasing competition. We believe these risks are largely mitigated because

our inventory typically turns in less than three months. Inventory was $7,903 million and $7,918 million at

February 2, 2013 and January 28, 2012, respectively, and is further described in Note 12 of the Notes to

Consolidated Financial Statements.

26