Target 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

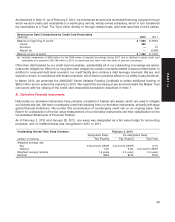

Total capital lease interest expense was $109 million in 2012 (including $78 million of interest expense on Canadian

capitalized leases), $69 million in 2011 (including $44 million of interest expense on Canadian capitalized leases)

and $16 million in 2010, and is included within net interest expense on the Consolidated Statements of Operations.

Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to

50 years. Certain leases also include options to purchase the leased property. Assets recorded under capital leases

as of February 2, 2013 and January 28, 2012 were $2,038 million and $1,752 million, respectively.

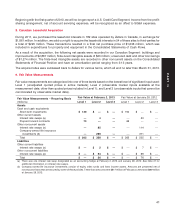

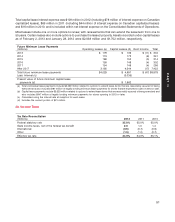

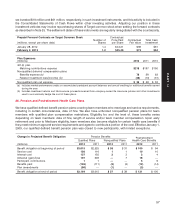

Future Minimum Lease Payments

(millions) Operating Leases (a) Capital Leases (b) Rent Income Total

2013 $ 179 $ 136 $ (11) $ 304

2014 174 173 (6) 341

2015 169 150 (5) 314

2016 158 148 (4) 302

2017 154 146 (4) 296

After 2017 3,195 4,244 (17) 7,422

Total future minimum lease payments $4,029 $ 4,997 $ (47) $8,979

Less: Interest (c) (3,035)

Present value of future minimum capital lease

payments (d) $ 1,962

(a) Total contractual lease payments include $2,039 million related to options to extend lease terms that are reasonably assured of being

exercised and also includes $181 million of legally binding minimum lease payments for stores that are expected to open in 2013 or later.

(b) Capital lease payments include $3,323 million related to options to extend lease terms that are reasonably assured of being exercised and

also includes $947 million of legally binding minimum payments for stores opening in 2013 or later.

(c) Calculated using the interest rate at inception for each lease.

(d) Includes the current portion of $21 million.

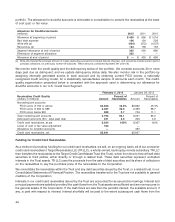

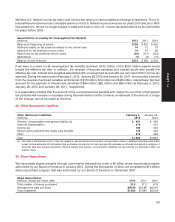

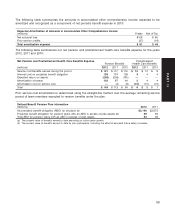

23. Income Taxes

Tax Rate Reconciliation

(millions) 2012 2011 2010

Federal statutory rate 35.0% 35.0% 35.0%

State income taxes, net of the federal tax benefit 2.0 1.0 1.4

International (0.6) (0.7) (0.6)

Other (1.5) (1.0) (0.7)

Effective tax rate 34.9% 34.3% 35.1%

51

PART II