Target 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

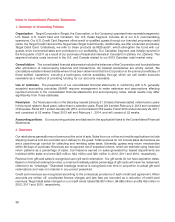

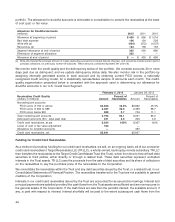

Beginning with the first quarter of 2013, we will no longer report a U.S. Credit Card Segment. Income from the profit-

sharing arrangement, net of account servicing expenses, will be recognized as an offset to SG&A expenses.

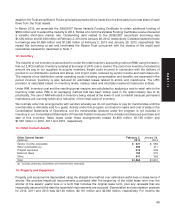

8. Canadian Leasehold Acquisition

During 2011, we purchased the leasehold interests in 189 sites operated by Zellers in Canada, in exchange for

$1,861 million. In addition, we sold our right to acquire the leasehold interests in 54 of these sites to third-parties for

a total of $225 million. These transactions resulted in a final net purchase price of $1,636 million, which was

included in expenditures for property and equipment in the Consolidated Statements of Cash Flows.

As a result of the acquisition, the following net assets were recorded in our Canadian Segment: buildings and

improvements of $2,887 million; finite-lived intangible assets of $23 million; unsecured debt and other borrowings

of $1,274 million. The finite-lived intangible assets are recorded in other noncurrent assets on the Consolidated

Statements of Financial Position and have an amortization period ranging from 3-13 years.

The acquired sites were subleased back to Zellers for various terms, which all end no later than March 31, 2013.

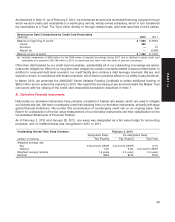

9. Fair Value Measurements

Fair value measurements are categorized into one of three levels based on the lowest level of significant input used:

Level 1 (unadjusted quoted prices in active markets); Level 2 (observable market inputs available at the

measurement date, other than quoted prices included in Level 1); and Level 3 (unobservable inputs that cannot be

corroborated by observable market data).

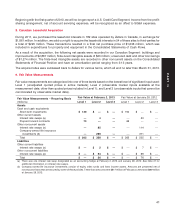

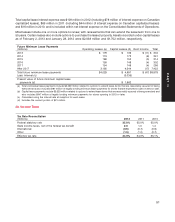

Fair Value at February 2, 2013 Fair Value at January 28, 2012

Fair Value Measurements – Recurring Basis

(millions) Level 1 Level 2 Level 3 Level 1 Level 2 Level 3

Assets

Cash and cash equivalents

Short-term investments $130 $— $— $194 $— $—

Other current assets

Interest rate swaps (a) —4——20—

Prepaid forward contracts 73 — — 69 — —

Other noncurrent assets

Interest rate swaps (a) —85 — — 114 —

Company-owned life insurance

investments (b) — 269 — — 371 —

Total $ 203 $ 358 $ — $ 263 $ 505 $ —

Liabilities

Other current liabilities

Interest rate swaps (a) $— $ 2 $— $— $ 7 $—

Other noncurrent liabilities

Interest rate swaps (a) $— $54 $— $— $69 $—

Total $— $56 $— $— $76 $—

(a) There was one interest rate swap designated as an accounting hedge at February 2, 2013 and January 28, 2012. See Note 21 for

additional information on interest rate swaps.

(b) Company-owned life insurance investments consist of equity index funds and fixed income assets. Amounts are presented net of

nonrecourse loans that are secured by some of these policies. These loan amounts were $817 million at February 2, 2013 and $669 million

at January 28, 2012.

41

PART II