Target 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

we invested $19 million and $61 million, respectively, in such investment instruments, and this activity is included in

the Consolidated Statements of Cash Flows within other investing activities. Adjusting our position in these

investment vehicles may involve repurchasing shares of Target common stock when settling the forward contracts

as described in Note 25. The settlement dates of these instruments are regularly renegotiated with the counterparty.

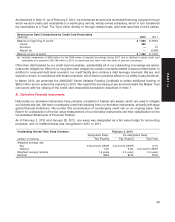

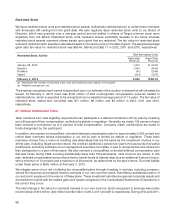

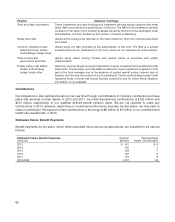

ContractualPrepaid Forward Contracts on Target Common Stock

Number of Price Paid Contractual Total Cash

(millions, except per share data) Shares per Share Fair Value Investment

January 28, 2012 1.4 $44.21 $69 $61

February 2, 2013 1.2 $45.46 $73 $54

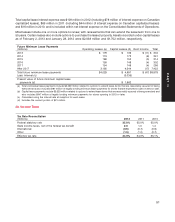

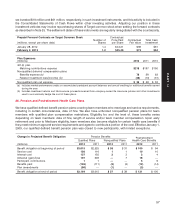

Plan Expenses

(millions) 2012 2011 2010

401(k) plan

Matching contributions expense $218 $197 $190

Nonqualified deferred compensation plans

Benefits expense (a) 78 38 63

Related investment loss/(income) (b) (43) (10) (31)

Nonqualified plan net expense $35 $28 $32

(a) Includes market-performance credits on accumulated participant account balances and annual crediting for additional benefits earned

during the year.

(b) Includes investment returns and life-insurance proceeds received from company-owned life insurance policies and other investments

used to economically hedge the cost of these plans.

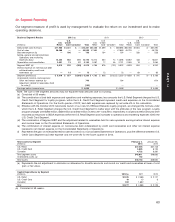

28. Pension and Postretirement Health Care Plans

We have qualified defined benefit pension plans covering team members who meet age and service requirements,

including in certain circumstances, date of hire. We also have unfunded nonqualified pension plans for team

members with qualified plan compensation restrictions. Eligibility for, and the level of, these benefits varies

depending on team members’ date of hire, length of service and/or team member compensation. Upon early

retirement and prior to Medicare eligibility, team members also become eligible for certain health care benefits if

they meet minimum age and service requirements and agree to contribute a portion of the cost. Effective January 1,

2009, our qualified defined benefit pension plan was closed to new participants, with limited exceptions.

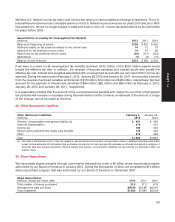

Change in Projected Benefit Obligation Pension Benefits Postretirement

Qualified Plans Nonqualified Plans Health Care Benefits

(millions) 2012 2011 2012 2011 2012 2011

Benefit obligation at beginning of period $3,015 $2,525 $38 $31 $ 100 $94

Service cost 120 116 1110 10

Interest cost 137 135 2234

Actuarial (gain)/loss 107 349 —718 —

Participant contributions 11——56

Benefits paid (126) (111) (3) (3) (12) (14)

Plan amendments (90) —(1) —(3) —

Benefit obligation at end of period $3,164 $3,015 $37 $38 $ 121 $ 100

57

PART II