Target 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

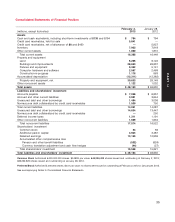

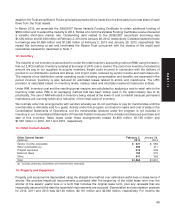

Position Valuation Technique

Short-term Carrying value approximates fair value because maturities are less than three months.

investments

Prepaid forward Initially valued at transaction price. Subsequently valued by reference to the market price of

contracts Target common stock.

Interest rate swaps Valuation models are calibrated to initial trade price. Subsequent valuations are based on

observable inputs to the valuation model (e.g., interest rates and credit spreads). Model inputs

are changed only when corroborated by market data. A credit-risk adjustment is made on

each swap using observable market credit spreads.

Company-owned life Includes investments in separate accounts that are valued based on market rates credited by

insurance the insurer.

investments

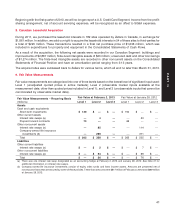

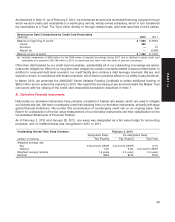

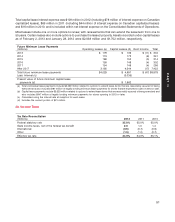

The following table presents the carrying amounts and estimated fair values of financial instruments not measured

at fair value in the Consolidated Statements of Financial Position. The fair value of marketable securities is

determined using available market prices at the reporting date and would be classified as Level 1. The fair value of

debt is generally measured using a discounted cash flow analysis based on current market interest rates for similar

types of financial instruments and would be classified as Level 2.

February 2, 2013 January 28, 2012

Financial Instruments Not Measured at Fair Value

Carrying Fair Carrying Fair

(millions) Amount Value Amount Value

Financial assets

Other current assets

Marketable securities (a) $61$61$35$35

Other noncurrent assets

Marketable securities (a) 44 66

Total $65$65$41$41

Financial liabilities

Total debt (b) $15,618 $18,143 $15,680 $18,142

Total $15,618 $18,143 $15,680 $18,142

(a) Represents held-to-maturity investments and cash equivalents that are held to satisfy the regulatory requirements of Target Bank and Target

National Bank.

(b) Represents the sum of nonrecourse debt collateralized by credit card receivables and unsecured debt and other borrowings, excluding

unamortized swap valuation adjustments and capital lease obligations.

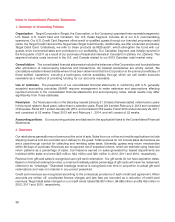

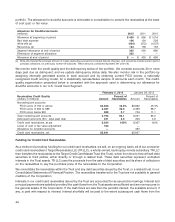

As of February 2, 2013, our consumer credit card receivables are recorded at the lower of cost (par) or fair value

because they are classified as held for sale. We estimated the fair value of our consumer credit card portfolio to be

approximately $6.3 billion using a cash flow-based, economic-profit model using Level 3 inputs, including the

forecasted performance of the portfolio and a market-based discount rate. We used internal data to forecast

expected payment patterns and write-offs, revenue, and operating expenses (credit EBIT yield) related to the credit

card portfolio. Changes in macroeconomic conditions in the United States could affect the estimated fair value used

in our lower of cost (par) or fair value assessment, which could cause gains or losses on our receivables held for

sale. A one percentage point change in the forecasted credit EBIT yield would impact our fair value estimate by

approximately $37 million. A one percentage point change in the forecasted discount rate would impact our fair

value estimate by approximately $8 million. Refer to Note 7 for more information on our credit card receivables

transaction. As of January 28, 2012, we estimated that the fair value of our credit card receivables approximated par

value.

The carrying amounts of accounts payable and certain accrued and other current liabilities approximate fair value

due to their short-term nature.

42