Target 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

portfolio. The allowance for doubtful accounts is eliminated in consolidation to present the receivables at the lower

of cost (par) or fair value.

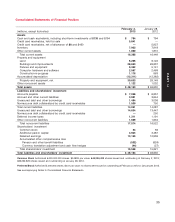

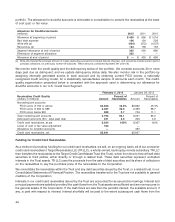

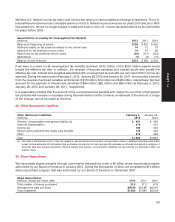

Allowance for Doubtful Accounts

(millions) 2012 2011 2010

Allowance at beginning of period $ 430 $ 690 $ 1,016

Bad debt expense 196 154 528

Write-offs (a) (424) (572) (1,007)

Recoveries (a) 133 158 153

Segment allowance at end of period 335 430 690

Elimination of segment allowance 335 ——

Allowance at end of period $— $ 430 $ 690

(a) Write-offs include the principal amount of losses (excluding accrued and unpaid finance charges), and recoveries include current period

principal collections on previously written-off balances. These amounts combined represent net write-offs.

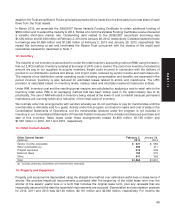

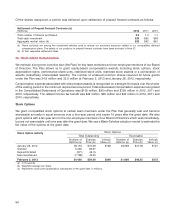

We monitor both the credit quality and the delinquency status of the portfolio. We consider accounts 30 or more

days past due as delinquent, and we update delinquency status daily. We also monitor risk in the portfolio by

assigning internally generated scores to each account and by obtaining current FICO scores, a nationally

recognized credit scoring model, for a statistically representative sample of accounts each month. The credit-

quality segmentation presented below is consistent with the approach used in determining our allowance for

doubtful accounts in our U.S. Credit Card Segment.

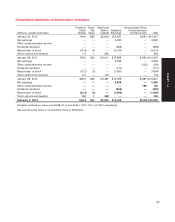

February 2, 2013 January 28, 2012

Percent of Percent ofReceivables Credit Quality

(dollars in millions) Amount Receivables Amount Receivables

Nondelinquent accounts

FICO score of 700 or above $2,826 46.8% $2,882 45.4%

FICO score of 600 to 699 2,387 39.6 2,463 38.7

FICO score below 600 580 9.7 706 11.1

Total nondelinquent accounts 5,793 96.1 6,051 95.2

Delinquent accounts (30+ days past due) 231 3.9 306 4.8

Credit card receivables, at par 6,024 100% 6,357 100%

Lower of cost or fair value adjustment 183 —

Allowance for doubtful accounts —430

Credit card receivables, net $5,841 $5,927

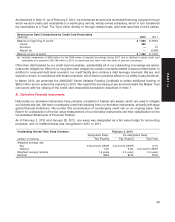

Funding for Credit Card Receivables

As a method of providing funding for our credit card receivables, we sell, on an ongoing basis, all of our consumer

credit card receivables to Target Receivables LLC (TR LLC), a wholly owned, bankruptcy remote subsidiary. TR LLC

then transfers the receivables to the Target Credit Card Master Trust (the Trust), which from time to time will sell debt

securities to third parties, either directly or through a related trust. These debt securities represent undivided

interests in the Trust assets. TR LLC uses the proceeds from the sale of debt securities and its share of collections

on the receivables to pay the purchase price of the receivables to the Corporation.

We consolidate the receivables within the Trust and any debt securities issued by the Trust, or a related trust, in our

Consolidated Statements of Financial Position. The receivables transferred to the Trust are not available to general

creditors of the Corporation.

Interests in our credit card receivables issued by the Trust are accounted for as secured borrowings. Interest and

principal payments are satisfied provided the cash flows from the Trust assets are sufficient and are nonrecourse to

the general assets of the Corporation. If the cash flows are less than the periodic interest, the available amount, if

any, is paid with respect to interest. Interest shortfalls will be paid to the extent subsequent cash flows from the

44