Target 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the symbol ‘‘TGT.’’ We are authorized to issue

up to 6,000,000,000 shares of common stock, par value $0.0833, and up to 5,000,000 shares of preferred stock, par

value $0.01. At March 15, 2013, there were 16,412 shareholders of record. Dividends declared per share and the

high and low closing common stock price for each fiscal quarter during 2012 and 2011 are disclosed in Note 30 of

the Notes to Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data.

During the first quarter of 2012, we completed a $10 billion share repurchase program authorized by our Board of

Directors in November 2007. In January 2012, our Board of Directors authorized the repurchase of an additional

$5 billion of our common stock, with no stated expiration for the share repurchase program. Since the inception of

the $5 billion share repurchase program and through the end of 2012, we have repurchased 27.3 million shares of

our common stock for a total cash investment of $1,621 million ($59.44 average price per share).

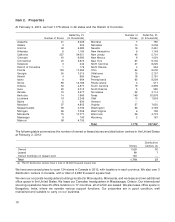

The table below presents information with respect to Target common stock purchases made during the three

months ended February 2, 2013 by Target or any ‘‘affiliated purchaser’’ of Target, as defined in Rule 10b-18(a)(3)

under the Exchange Act.

Total Number of Dollar Value of

Total Number Average Shares Purchased Shares that May

of Shares Price Paid as Part of the Yet Be Purchased

Period Purchased (a)(b) per Share (a) Current Program (a) Under the Program

October 28, 2012 through

November 24, 2012 4,439,108 $62.78 21,304,584 $ 3,744,999,754

November 25, 2012 through

December 29, 2012 2,711,006 62.10 23,984,097 3,578,603,382

December 30, 2012 through

February 2, 2013 3,351,633 60.74 27,276,377 3,378,630,009

10,501,747 $61.96 27,276,377 $3,378,630,009

(a) The table above includes shares reacquired upon settlement of prepaid forward contracts. For the three months ended February 2, 2013, no

shares were reacquired through these contracts. At February 2, 2013, we held asset positions in prepaid forward contracts for 1.2 million

shares of our common stock, for a total cash investment of $54 million, or an average per share price of $45.46. Refer to Notes 25 and 27 of

the Notes to Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data for further details of these

contracts.

(b) The number of shares above includes shares of common stock reacquired from team members who tendered owned shares to satisfy the

tax withholding on equity awards as part of our long-term incentive plans or to satisfy the exercise price on stock option exercises. For the

three months ended February 2, 2013, 91,565 shares were reacquired at an average per share price of $60.73 pursuant to our long-term

incentive plan.

12