Target 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

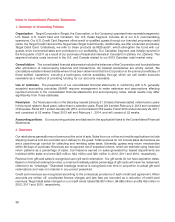

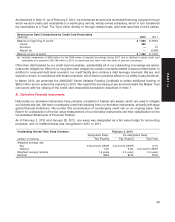

10. Cash Equivalents

Cash equivalents include highly liquid investments with an original maturity of three months or less from the time of

purchase. These investments were $130 million and $194 million at February 2, 2013 and January 28, 2012,

respectively. Cash equivalents also include amounts due from third-party financial institutions for credit and debit

card transactions. These receivables typically settle in less than five days and were $371 million and $330 million at

February 2, 2013 and January 28, 2012, respectively. Payables due to Visa resulting from the use of Target Visa

Cards are included within cash equivalents and were $34 million and $35 million at February 2, 2013 and

January 28, 2012, respectively.

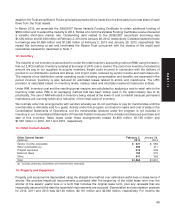

11. Credit Card Receivables

Historically, our credit card receivables were recorded at par value less an allowance for doubtful accounts. As of

February 2, 2013, our consumer credit card receivables are recorded at the lower of cost (par) or fair value because

they are classified as held for sale. Lower of cost (par) or fair value was determined on a segmented basis using the

delinquency and credit-quality segmentation we have historically used to determine the allowance for doubtful

accounts. Many nondelinquent balances are recorded at cost (par) because fair value exceeds cost. Delinquent

balances are generally recorded at fair value, which reflects our expectation of losses on these receivables. Refer to

Note 7 for more information on our credit card receivables transaction.

Credit card receivables are our only significant class of financing receivables. Substantially all past-due accounts

accrue finance charges until they are written off. Accounts are written off when they become 180 days past due.

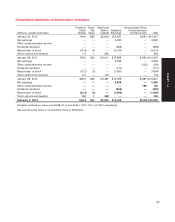

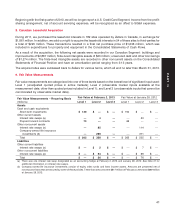

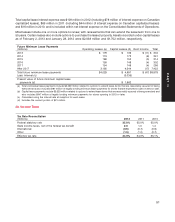

February 2, 2013 January 28, 2012

Age of Credit Card Receivables

Percent of Percent of

(dollars in millions) Amount Receivables Amount Receivables

Current $5,614 93.1% $5,791 91.1%

1-29 days past due 179 3.0 260 4.1

30-59 days past due 70 1.2 97 1.5

60-89 days past due 45 0.8 62 1.0

90+ days past due 116 1.9 147 2.3

Credit card receivables, at par $6,024 100% $6,357 100%

Lower of cost or fair value adjustment 183 —

Allowance for doubtful accounts —430

Credit card receivables, net $5,841 $5,927

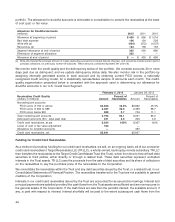

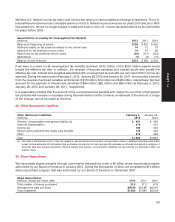

Allowance for Doubtful Accounts

Historically, we recognized an allowance for doubtful accounts in an amount equal to the anticipated future

write-offs of existing receivables and uncollectible finance charges and other credit-related fees. We estimated

future write-offs on the entire credit card portfolio collectively based on historical experience of delinquencies, risk

scores, aging trends and industry risk trends. We continue to recognize an allowance for doubtful accounts and

bad debt expense within our U.S. Credit Card Segment, which allows us to evaluate the performance of the

43

PART II