Target 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

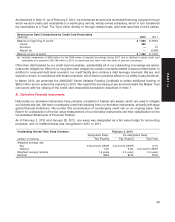

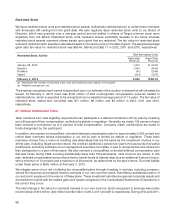

20. Notes Payable and Long-Term Debt

At February 2, 2013, the carrying value and maturities of our debt portfolio were as follows:

Debt Maturities February 2, 2013

(dollars in millions) Rate (a) Balance

Due 2013-2017 (b) 3.6% $ 6,031

Due 2018-2022 4.0 2,416

Due 2023-2027 6.7 171

Due 2028-2032 6.6 1,060

Due 2033-2037 6.8 3,501

Due 2038-2042 4.0 1,469

Total notes and debentures 4.7 14,648

Swap valuation adjustments 78

Capital lease obligations 1,952

Less: Amounts due within one year (2,024)

Long-term debt $14,654

(a) Reflects the weighted average stated interest rate as of year-end.

(b) Includes $1.5 billion of nonrecourse debt collateralized by credit card receivables. See Note 11.

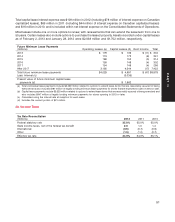

Required Principal Payments

(millions) 2013 2014 2015 2016 2017

Unsecured $ 501 $1,001 $ 27 $751 $2,251

Nonrecourse 1,500 — — — —

Total required principal payments $2,001 $1,001 $ 27 $751 $2,251

On March 13, 2013, we repaid $1.5 billion of outstanding nonrecourse debt as described in Note 7. As of March 20,

2013, we also have open tender offers to use up to an aggregate of $1.2 billion of cash proceeds from the sale of our

receivables portfolio to repurchase outstanding debt with original maturities between 2020 through 2038.

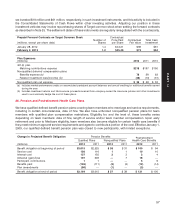

We periodically obtain short-term financing under our commercial paper program, a form of notes payable.

Commercial Paper

(dollars in millions) 2012 2011 2010

Maximum daily amount outstanding during the year $ 970 $1,211 $—

Average amount outstanding during the year 120 244 —

Amount outstanding at year-end 970 ——

Weighted average interest rate 0.16% 0.11% —%

In October 2011, we entered into a five-year $2.25 billion revolving credit facility that expires in October 2017. No

balances were outstanding at any time during 2012 or 2011.

In June 2012, we issued $1.5 billion of unsecured fixed rate debt at 4.0% that matures in July 2042. Proceeds from

this issuance were used for general corporate purposes.

48