Target 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

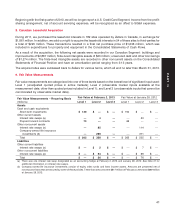

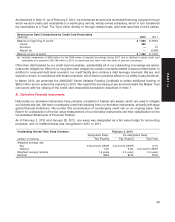

17. Accounts Payable

At February 2, 2013 and January 28, 2012, we reclassified book overdrafts of $588 million and $575 million,

respectively, to accounts payable.

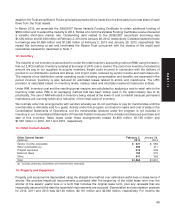

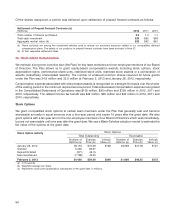

18. Accrued and Other Current Liabilities

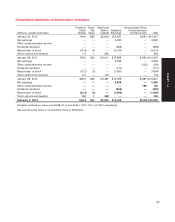

Accrued and Other Current Liabilities February 2, January 28,

(millions) 2013 2012

Wages and benefits $ 938 $ 898

Real estate, sales and other taxes payable 624 547

Gift card liability (a) 503 467

Project costs accrual 347 131

Income tax payable 272 257

Straight-line rent accrual (b) 235 215

Dividends payable 232 202

Workers’ compensation and general liability (c) 160 164

Interest payable 91 109

Other 579 654

Total $3,981 $3,644

(a) Gift card liability represents the amount of unredeemed gift cards, net of estimated breakage.

(b) Straight-line rent accrual represents the amount of rent expense recorded that exceeds cash payments remitted in connection with

operating leases.

(c) See footnote (a) to the Other Noncurrent Liabilities table in Note 24 for additional detail.

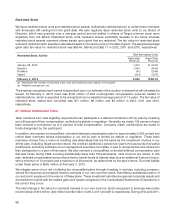

19. Commitments and Contingencies

Purchase obligations, which include all legally binding contracts such as firm commitments for inventory

purchases, merchandise royalties, equipment purchases, marketing-related contracts, software acquisition/license

commitments and service contracts, were $1,472 million and $1,396 million at February 2, 2013 and January 28,

2012, respectively. These purchase obligations are primarily due within three years. We issue inventory purchase

orders, which represent authorizations to purchase that are cancelable by their terms. We do not consider purchase

orders to be firm inventory commitments. If we choose to cancel a purchase order, we may be obligated to

reimburse the vendor for unrecoverable outlays incurred prior to cancellation.

We issue trade letters of credit in the ordinary course of business. Trade letters of credit totaled $1,539 million and

$1,516 million at February 2, 2013 and January 28, 2012, respectively, a portion of which are reflected in accounts

payable. Standby letters of credit, relating primarily to retained risk on our insurance claims, totaled $76 million and

$66 million at February 2, 2013 and January 28, 2012, respectively.

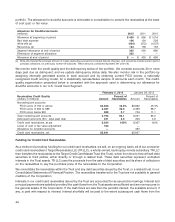

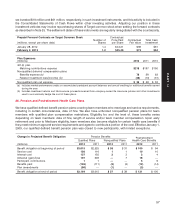

We are exposed to claims and litigation arising in the ordinary course of business and use various methods to

resolve these matters in a manner that we believe serves the best interest of our shareholders and other

constituents. We believe the recorded reserves in our consolidated financial statements are adequate in light of the

probable and estimable liabilities. We do not believe that any of the currently identified claims or litigation will be

material to our results of operations, cash flows or financial condition.

47

PART II