Target 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The collective interaction of a broad array of macroeconomic, competitive and consumer behavioral factors, as well

as sales mix, and transfer of sales to new stores makes further analysis of sales metrics infeasible.

Credit is offered to qualified guests through our branded proprietary credit cards: the Target Credit Card and the

Target Visa (Target Credit Cards). Additionally, we offer a branded proprietary Target Debit Card. Collectively, we

refer to these products as REDcardsᓼ. Since October 2010, guests receive a 5-percent discount on virtually all

purchases at checkout, every day, when they use a REDcard. In November 2011, guests also began to receive free

shipping at Target.com when they use their REDcard.

We monitor the percentage of store sales that are paid for using REDcards (REDcard Penetration) because our

internal analysis has indicated that a meaningful portion of the incremental purchases on our REDcards are also

incremental sales for Target, with the remainder representing a shift in tender type.

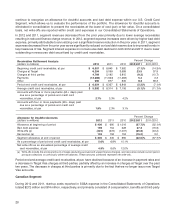

REDcard Penetration 2012 2011 2010

Target Credit Cards 7.9% 6.8% 5.2%

Target Debit Card 5.7 2.5 0.7%

Total store REDcard Penetration 13.6% 9.3% 5.9%

Gross Margin Rate

Our gross margin rate was 29.7 percent in 2012, 30.1 percent in 2011 and 30.5 percent in 2010. The decrease in

each period reflects the impact of our integrated growth strategies of our 5% REDcard Rewards loyalty program and

our store remodel program, which impacted the rate by 0.4 percent and 0.5 percent in 2012 and 2011, respectively,

partially offset by underlying rate improvements within categories in 2011. The REDcard Rewards loyalty program

reduces gross margin rates because it drives incremental sales among guests who receive a 5-percent discount on

virtually all items purchased. The remodel program reduces the overall gross margin rate because it drives

incremental sales with a stronger-than-average mix in lower-than-average gross margin rate product categories,

primarily food.

We changed certain merchandise vendor contracts beginning in 2013. As a result, we expect our gross margin rate

to increase by about 20 to 25 basis points from prior years, with an equal and offsetting increase in our SG&A rate.

This shift will result from a larger proportion of vendor income offsetting cost of sales as compared to certain

advertising expenses within SG&A. This change will have no impact on our EBITDA or EBIT margins or margin rates

as our SG&A rate will increase by the same amount.

In January 2013 we announced plans to price match top online retailers year-round. Based on our experience

during the 2012 holiday season, we do not expect this change to significantly affect our gross margin rate.

Selling, General and Administrative Expense Rate

Our SG&A expense rate was 19.9 percent, 20.1 percent and 20.3 percent in 2012, 2011 and 2010, respectively. The

change in 2012 was primarily due to improvements in store hourly payroll expense, which impacted the rate by

0.1 percent, and continued disciplined expense management across the Company, partially offset by technology

and multichannel investments, which impacted the rate by nearly 0.2 percent. The change in 2011 was primarily

due to increased loyalty program charges to the U.S. Credit Segment and favorable leverage on store hourly payroll

expense.

As noted above, a 2013 change to certain merchandise vendor contracts is expected to increase our SG&A rate by

about 20 to 25 basis points because vendor funding will no longer offset certain advertising expenses. This change

will have no impact on our EBITDA or EBIT margins or margin rates as our gross margin rate will increase by the

same amount.

Following the sale of our credit card portfolio in 2013, income from the profit-sharing arrangement, net of account

servicing expenses, will be recognized as an offset to SG&A expenses.

17

PART II