Target 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Certain discrete state income tax items reduced our effective tax rate by 1.0 percentage points, 2.0 percentage

points, and 2.4 percentage points in 2012, 2011 and 2010, respectively.

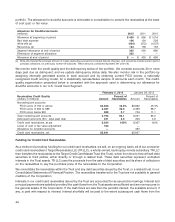

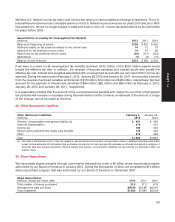

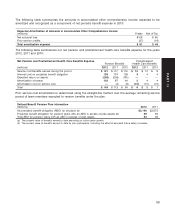

Provision for Income Taxes

(millions) 2012 2011 2010

Current:

Federal $1,471 $1,069 $1,086

State 135 74 40

International 18 13 4

Total current 1,624 1,156 1,130

Deferred:

Federal 124 427 388

State 14 —57

International (152) (56) —

Total deferred (14) 371 445

Total provision $1,610 $1,527 $1,575

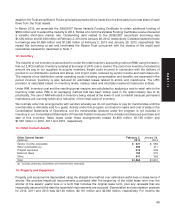

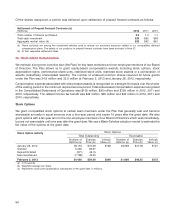

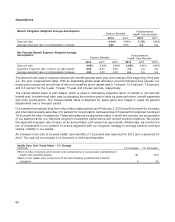

Net Deferred Tax Asset/(Liability) February 2, January 28,

(millions) 2013 2012

Gross deferred tax assets:

Accrued and deferred compensation $ 537 $ 489

Allowance for doubtful accounts and lower of cost or fair value adjustment on credit

card receivables held for sale 67 157

Accruals and reserves not currently deductible 352 347

Self-insured benefits 249 257

Foreign operating loss carryforward 189 43

Other 123 149

Total gross deferred tax assets 1,517 1,442

Gross deferred tax liabilities:

Property and equipment (1,995) (1,930)

Deferred credit card income (91) (102)

Inventory (210) (162)

Other (133) (109)

Total gross deferred tax liabilities (2,429) (2,303)

Total net deferred tax asset/(liability) $ (912) $ (861)

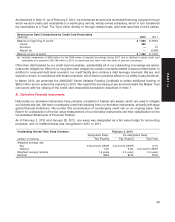

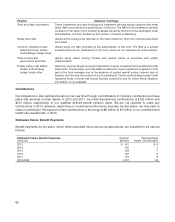

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary

differences between financial statement carrying amounts of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured using enacted income tax rates in effect for the year the

temporary differences are expected to be recovered or settled. Tax rate changes affecting deferred tax assets and

liabilities are recognized in income at the enactment date.

At February 2, 2013, we had foreign net operating loss carryforwards of $714 million, which are available to offset

future income. We expect substantially all of these carryforwards, which generally expire in 2031 and 2032, to be

fully utilized prior to expiration.

We have not recorded deferred taxes when earnings from foreign operations are considered to be indefinitely

invested outside the U.S. These accumulated net earnings relate to ongoing operations and were $52 million

($592 million earnings offset by deficits) at February 2, 2013 and $300 million ($483 million earnings offset by

deficits) at January 28, 2012. It is not practicable to determine the income tax liability that would be payable if such

earnings were repatriated.

52