Target 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We file a U.S. federal income tax return and income tax returns in various states and foreign jurisdictions. The U.S.

Internal Revenue Service has completed exams on the U.S. federal income tax returns for years 2010 and prior. With

few exceptions, we are no longer subject to state and local or non-U.S. income tax examinations by tax authorities

for years before 2003.

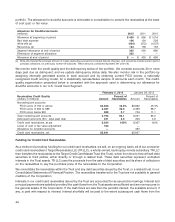

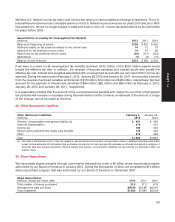

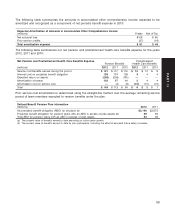

Reconciliation of Liability for Unrecognized Tax Benefits

(millions) 2012 2011 2010

Balance at beginning of period $236 $ 302 $ 452

Additions based on tax positions related to the current year 10 12 16

Additions for tax positions of prior years 19 31 68

Reductions for tax positions of prior years (42) (101) (222)

Settlements (7) (8) (12)

Balance at end of period $216 $ 236 $ 302

If we were to prevail on all unrecognized tax benefits recorded, $142 million of the $216 million reserve would

benefit the effective tax rate. In addition, the reversal of accrued penalties and interest would also benefit the

effective tax rate. Interest and penalties associated with unrecognized tax benefits are recorded within income tax

expense. During the years ended February 2, 2013, January 28, 2012 and January 29, 2011, we recorded a benefit

from the reversal of accrued penalties and interest of $16 million, $12 million and $28 million, respectively. We had

accrued for the payment of interest and penalties of $64 million, $82 million and $95 million at February 2, 2013,

January 28, 2012 and January 29, 2011, respectively.

It is reasonably possible that the amount of the unrecognized tax benefits with respect to our other unrecognized

tax positions will increase or decrease during the next twelve months; however, an estimate of the amount or range

of the change cannot be made at this time.

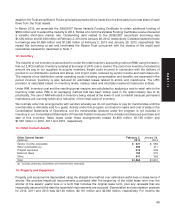

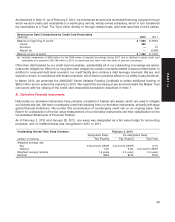

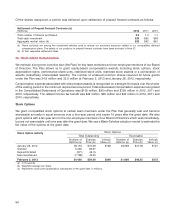

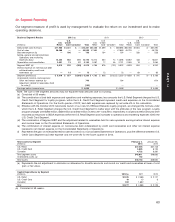

24. Other Noncurrent Liabilities

Other Noncurrent Liabilities February 2, January 28,

(millions) 2013 2012

Workers’ compensation and general liability (a) $ 467 $ 482

Deferred compensation 479 421

Income tax 180 224

Pension and postretirement health care benefits 170 225

Other 313 282

Total $1,609 $1,634

(a) We retain a substantial portion of the risk related to general liability and workers’ compensation claims. Liabilities associated with these

losses include estimates of both claims filed and losses incurred but not yet reported. We estimate our ultimate cost based on analysis of

historical data and actuarial estimates. General liability and workers’ compensation liabilities are recorded at our estimate of their net

present value.

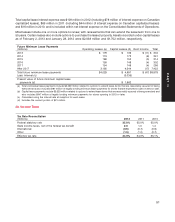

25. Share Repurchase

We repurchase shares primarily through open market transactions under a $5 billion share repurchase program

authorized by our Board of Directors in January 2012. During the first quarter of 2012, we completed a $10 billion

share repurchase program that was authorized by our Board of Directors in November 2007.

Share Repurchases

(millions, except per share data) 2012 2011 2010

Total number of shares purchased 32.2 37.2 47.8

Average price paid per share $58.96 $50.89 $52.44

Total investment $1,900 $1,894 $2,508

53

PART II