Target 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

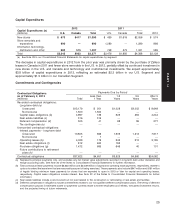

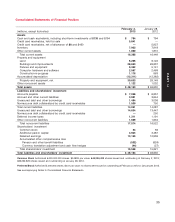

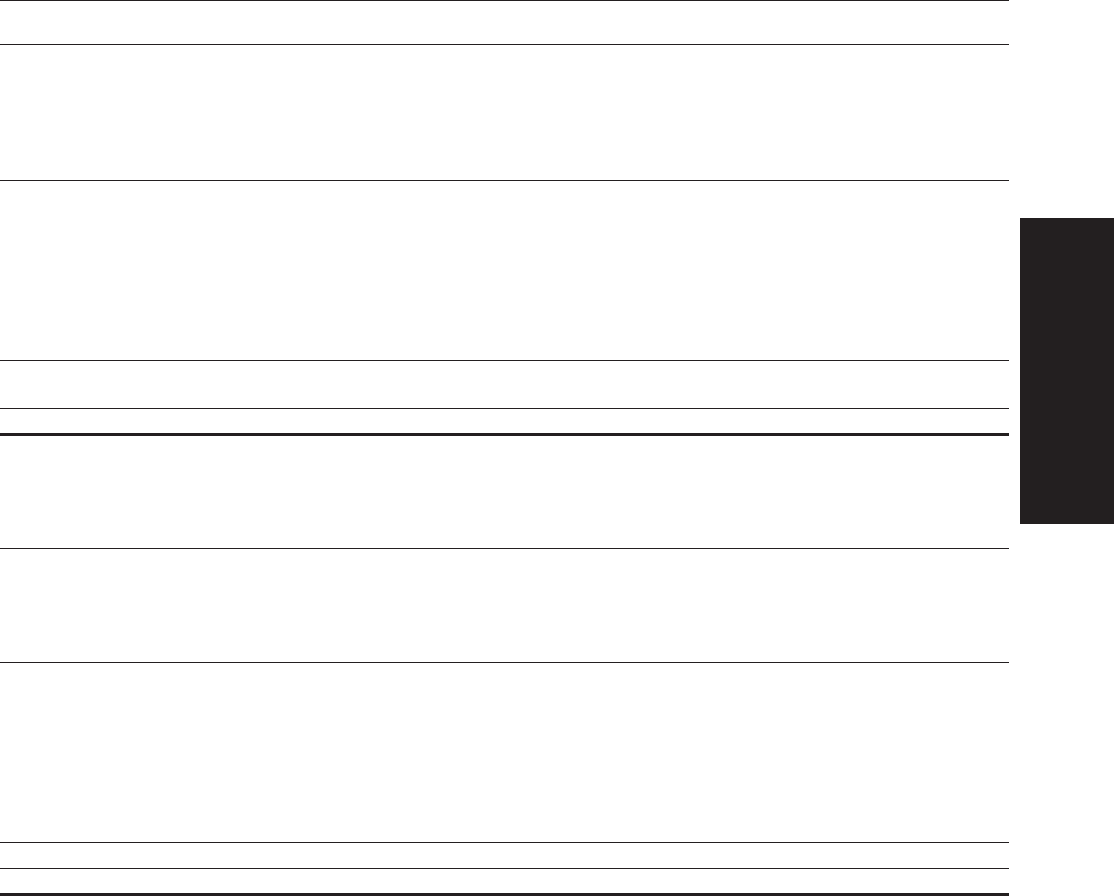

Consolidated Statements of Financial Position

February 2, January 28,

(millions, except footnotes) 2013 2012

Assets

Cash and cash equivalents, including short-term investments of $130 and $194 $ 784 $ 794

Credit card receivables, held for sale 5,841 —

Credit card receivables, net of allowance of $0 and $430 —5,927

Inventory 7,903 7,918

Other current assets 1,860 1,810

Total current assets 16,388 16,449

Property and equipment

Land 6,206 6,122

Buildings and improvements 28,653 26,837

Fixtures and equipment 5,362 5,141

Computer hardware and software 2,567 2,468

Construction-in-progress 1,176 963

Accumulated depreciation (13,311) (12,382)

Property and equipment, net 30,653 29,149

Other noncurrent assets 1,122 1,032

Total assets $ 48,163 $ 46,630

Liabilities and shareholders’ investment

Accounts payable $ 7,056 $ 6,857

Accrued and other current liabilities 3,981 3,644

Unsecured debt and other borrowings 1,494 3,036

Nonrecourse debt collateralized by credit card receivables 1,500 750

Total current liabilities 14,031 14,287

Unsecured debt and other borrowings 14,654 13,447

Nonrecourse debt collateralized by credit card receivables —250

Deferred income taxes 1,311 1,191

Other noncurrent liabilities 1,609 1,634

Total noncurrent liabilities 17,574 16,522

Shareholders’ investment

Common stock 54 56

Additional paid-in capital 3,925 3,487

Retained earnings 13,155 12,959

Accumulated other comprehensive loss

Pension and other benefit liabilities (532) (624)

Currency translation adjustment and cash flow hedges (44) (57)

Total shareholders’ investment 16,558 15,821

Total liabilities and shareholders’ investment $ 48,163 $ 46,630

Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 645,294,423 shares issued and outstanding at February 2, 2013;

669,292,929 shares issued and outstanding at January 28, 2012.

Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2013 or January 28, 2012.

See accompanying Notes to Consolidated Financial Statements.

35

PART II