Target 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

purposes, accelerated depreciation methods are generally used. Repair and maintenance costs are expensed as

incurred and were $695 million, $666 million and $726 million in 2012, 2011 and 2010, respectively. Facility

pre-opening costs, including supplies and payroll, are expensed as incurred.

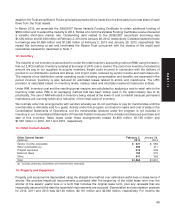

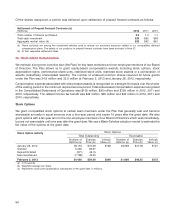

Estimated Useful Lives Life (Years)

Buildings and improvements 8-39

Fixtures and equipment 3-15

Computer hardware and software 4-7

Long-lived assets are reviewed for impairment when events or changes in circumstances indicate that the asset’s

carrying value may not be recoverable. Impairments of $37 million, $43 million and $34 million in 2012, 2011 and

2010, respectively, were recorded as a result of the reviews performed and project scope changes.

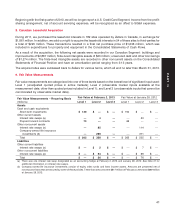

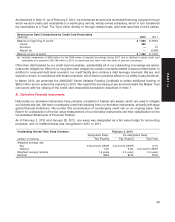

15. Other Noncurrent Assets

Other Noncurrent Assets February 2, January 28,

(millions) 2013 2012

Company-owned life insurance investments (a) $ 269 $ 371

Goodwill and intangible assets 224 242

Deferred taxes 206 56

Interest rate swaps (b) 85 114

Other 338 249

Total $1,122 $1,032

(a) Company-owned life insurance policies on approximately 4,000 team members who have been designated highly compensated under

the Internal Revenue Code and have given their consent to be insured. Amounts are presented net of loans that are secured by some of

these policies.

(b) See Notes 9 and 21 for additional information relating to our interest rate swaps.

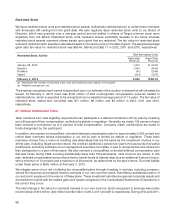

16. Goodwill and Intangible Assets

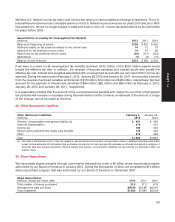

Goodwill totaled $59 million at February 2, 2013 and January 28, 2012. No impairments were recorded in 2012,

2011 or 2010 as a result of the goodwill impairment tests performed.

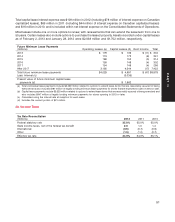

Intangible Assets Leasehold

Acquisition Costs Other (a) Total

February 2, January 28, February 2, January 28, February 2, January 28,

(millions) 2013 2012 2013 2012 2013 2012

Gross asset $ 237 $ 243 $ 149 $146 $ 386 $ 389

Accumulated amortization (120) (119) (101) (87) (221) (206)

Net intangible assets $ 117 $ 124 $48 $59 $ 165 $ 183

(a) Other intangible assets relate primarily to acquired customer lists and trademarks.

We use the straight-line method to amortize leasehold acquisition costs primarily over 9 to 39 years and other

definite-lived intangibles over 3 to 15 years. The weighted average life of leasehold acquisition costs and other

intangible assets was 29 years and 5 years, respectively, at February 2, 2013. Amortization expense was $22 million

in 2012 and $24 million in each of 2011 and 2010.

Estimated Amortization Expense

(millions) 2013 2014 2015 2016 2017

Amortization expense $24 $21 $20 $19 $14

46