Target 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

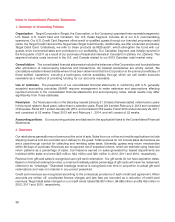

Since October 2010, guests receive a 5-percent discount on virtually all purchases at checkout every day when they

use a REDcard. In November 2011, guests also began to receive free shipping at Target.com when they use their

REDcard. The discounts associated with loyalty programs are included as reductions in sales in our Consolidated

Statements of Operations and were $583 million, $340 million and $162 million in 2012, 2011 and 2010,

respectively.

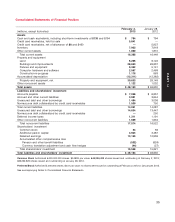

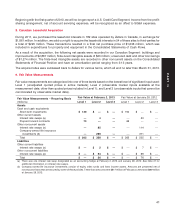

3. Cost of Sales and Selling, General and Administrative Expenses

The following table illustrates the primary costs classified in each major expense category:

Cost of Sales Selling, General and Administrative Expenses

Total cost of products sold including Compensation and benefit costs including

• Freight expenses associated with moving • Stores

merchandise from our vendors to our distribution • Headquarters

centers and our retail stores, and among our Occupancy and operating costs of retail and

distribution and retail facilities headquarters facilities

• Vendor income that is not reimbursement of Advertising, offset by vendor income that is a

specific, incremental and identifiable costs reimbursement of specific, incremental and

Inventory shrink identifiable costs

Markdowns Pre-opening costs of stores and other facilities

Outbound shipping and handling expenses Other administrative costs

associated with sales to our guests

Payment term cash discounts

Distribution center costs, including compensation

and benefits costs

Import cost

Note: The classification of these expenses varies across the retail industry.

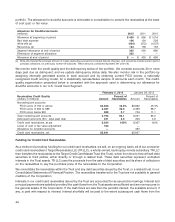

4. Consideration Received from Vendors

We receive consideration for a variety of vendor-sponsored programs, such as volume rebates, markdown

allowances, promotions and advertising allowances and for our compliance programs, referred to as ‘‘vendor

income.’’ Vendor income reduces either our inventory costs or SG&A expenses based on the provisions of the

arrangement. Promotional and advertising allowances are intended to offset our costs of promoting and selling

merchandise in our stores. Under our compliance programs, vendors are charged for merchandise shipments that

do not meet our requirements (violations), such as late or incomplete shipments. These allowances are recorded

when violations occur. Substantially all consideration received is recorded as a reduction of cost of sales.

We establish a receivable for vendor income that is earned but not yet received. Based on provisions of the

agreements in place, this receivable is computed by estimating the amount earned when we have completed our

performance. We perform detailed analyses to determine the appropriate level of the receivable in the aggregate.

The majority of year-end receivables associated with these activities are collected within the following fiscal quarter.

We have not historically had significant write-offs for these receivables.

39

PART II