Target 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

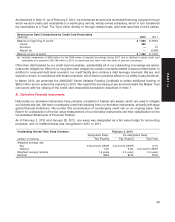

assets in the Trust are sufficient. Future principal payments will be made from the third party’s pro rata share of cash

flows from the Trust assets.

In March 2012, we amended the 2006/2007 Series Variable Funding Certificate to obtain additional funding of

$500 million and to extend the maturity to 2013. Parties who hold the Variable Funding Certificate receive interest at

a variable short-term market rate. Outstanding debt related to the 2006/2007 securitized borrowing was

$1,500 million and $1,000 million at February 2, 2013 and January 28, 2012, respectively. Collateral related to these

borrowings was $1,899 million and $1,266 million at February 2, 2013 and January 28, 2012, respectively. We

repaid this borrowing at par and terminated the Master Trust concurrent with the closing of the credit card

receivables transaction described in Note 7.

12. Inventory

The majority of our inventory is accounted for under the retail inventory accounting method (RIM) using the last-in,

first-out (LIFO) method. Inventory is stated at the lower of LIFO cost or market. The cost of our inventory includes the

amount we pay to our suppliers to acquire inventory, freight costs incurred in connection with the delivery of

product to our distribution centers and stores, and import costs, reduced by vendor income and cash discounts.

The majority of our distribution center operating costs, including compensation and benefits, are expensed in the

period incurred. Inventory is also reduced for estimated losses related to shrink and markdowns. The LIFO

provision is calculated based on inventory levels, markup rates and internally measured retail price indices.

Under RIM, inventory cost and the resulting gross margins are calculated by applying a cost-to-retail ratio to the

inventory retail value. RIM is an averaging method that has been widely used in the retail industry due to its

practicality. The use of RIM will result in inventory being valued at the lower of cost or market because permanent

markdowns are currently taken as a reduction of the retail value of inventory.

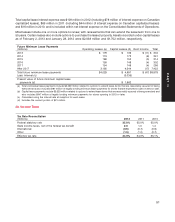

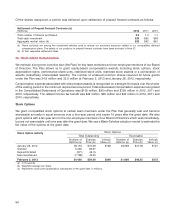

We routinely enter into arrangements with vendors whereby we do not purchase or pay for merchandise until the

merchandise is ultimately sold to a guest. Activity under this program is included in sales and cost of sales in the

Consolidated Statements of Operations, but the merchandise received under the program is not included in

inventory in our Consolidated Statements of Financial Position because of the virtually simultaneous purchase and

sale of this inventory. Sales made under these arrangements totaled $1,800 million, $1,736 million and

$1,581 million in 2012, 2011 and 2010, respectively.

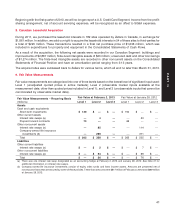

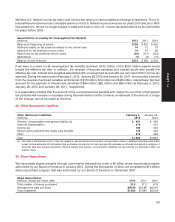

13. Other Current Assets

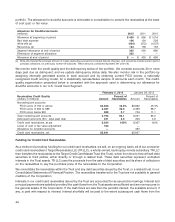

Other Current Assets February 2, January 28,

(millions) 2013 2012

Vendor income receivable $ 621 $ 592

Other receivables (a) 395 411

Prepaid expenses 310 206

Deferred taxes 193 275

Other 341 326

Total $1,860 $1,810

(a) Includes pharmacy receivables and income taxes receivable.

14. Property and Equipment

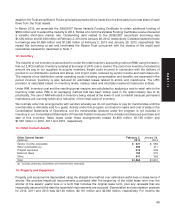

Property and equipment is depreciated using the straight-line method over estimated useful lives or lease terms if

shorter. We amortize leasehold improvements purchased after the beginning of the initial lease term over the

shorter of the assets’ useful lives or a term that includes the original lease term, plus any renewals that are

reasonably assured at the date the leasehold improvements are acquired. Depreciation and amortization expense

for 2012, 2011 and 2010 was $2,120 million, $2,107 million and $2,060 million, respectively. For income tax

45

PART II