Target 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

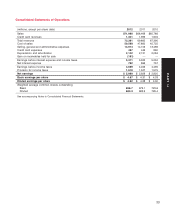

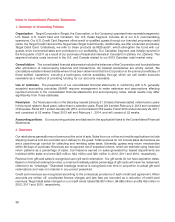

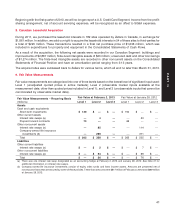

5. Advertising Costs

Advertising costs, which primarily consist of newspaper circulars, internet advertisements and media broadcast,

are expensed at first showing or distribution of the advertisement, and are recorded net of related vendor income.

Advertising Costs

(millions) 2012 2011 2010

Gross advertising costs $1,653 $1,589 $1,490

Vendor income 231 229 198

Net advertising costs $1,422 $1,360 $1,292

6. Earnings per Share

Basic earnings per share (EPS) is calculated as net earnings divided by the weighted average number of common

shares outstanding during the period. Diluted EPS includes the potentially dilutive impact of share-based awards

outstanding at period end, consisting of the incremental shares assumed to be issued upon the exercise of stock

options and the incremental shares assumed to be issued under performance share and restricted stock unit

arrangements.

Earnings Per Share

(millions, except per share data) 2012 2011 2010

Net earnings $2,999 $2,929 $2,920

Basic weighted average common shares outstanding 656.7 679.1 723.6

Dilutive impact of share-based awards (a) 6.6 4.8 5.8

Dilutive weighted average common shares outstanding 663.3 683.9 729.4

Basic earnings per share $ 4.57 $ 4.31 $ 4.03

Dilutive earnings per share $ 4.52 $ 4.28 $ 4.00

(a) Excludes 5.0 million, 15.5 million and 10.9 million share-based awards for 2012, 2011 and 2010, respectively, because their effects were

antidilutive.

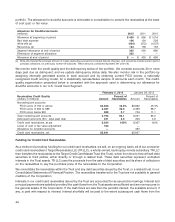

7. Credit Card Receivables Transaction

On October 22, 2012, we reached an agreement to sell our entire consumer credit card portfolio to TD Bank Group

(TD) for cash consideration equal to the gross (par) value of the outstanding receivables at the time of closing.

Historically, our credit card receivables were recorded at par value less an allowance for doubtful accounts. With

this agreement, our receivables are classified as held for sale at February 2, 2013, and are recorded at the lower of

cost (par) or fair value. We recorded a gain of $161 million outside of our segments in 2012, representing the net

adjustment to eliminate our allowance for doubtful accounts and record our receivables at lower of cost (par) or fair

value.

On March 13, 2013, we completed the sale to TD for cash consideration of $5.7 billion, equal to the gross (par) value

of the outstanding receivables at the time of closing. Subsequent to year-end, and concurrent with the sale of the

portfolio, we repaid the nonrecourse debt collateralized by credit card receivables (2006/2007 Series Variable

Funding Certificate) at par of $1.5 billion, resulting in net cash proceeds of $4.2 billion. As of March 20, 2013, we

also have open tender offers to use up to an aggregate of $1.2 billion of cash proceeds from the sale to repurchase

outstanding debt.

Following this sale, TD will underwrite, fund and own Target Credit Card and Target Visa receivables in the U.S. TD

will control risk management policies and oversee regulatory compliance, and we will perform account servicing

and primary marketing functions. We will earn a substantial portion of the profits generated by the Target Credit

Card and Target Visa portfolios. This transaction will be accounted for as a sale, and the receivables will no longer

be reported on our Consolidated Statements of Financial Position.

40