Target 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Item 1. Business

General

Target Corporation (the Corporation or Target) was incorporated in Minnesota in 1902. We operate as three

reportable segments: U.S. Retail, U.S. Credit Card and Canadian.

Our U.S. Retail Segment includes all of our U.S. merchandising operations. We offer both everyday essentials and

fashionable, differentiated merchandise at discounted prices. Our ability to deliver a shopping experience that is

preferred by our customers, referred to as ‘‘guests,’’ is supported by our strong supply chain and technology

infrastructure, a devotion to innovation that is ingrained in our organization and culture, and our disciplined

approach to managing our current business and investing in future growth. Our business is designed to enable

guests to purchase products seamlessly in stores, online or through their mobile device.

Our U.S. Credit Card Segment offers credit to qualified guests through our branded proprietary credit cards: the

Target Credit Card and the Target Visa. Additionally, we offer a branded proprietary Target Debit Card. Collectively,

these REDcardsᓼ help strengthen the bond with our guests, drive incremental sales and contribute to our results of

operations. In the first quarter of 2013, we sold our credit card receivables portfolio. Subsequent to the sale, we will

perform account servicing and primary marketing functions, and will earn a substantial portion of the profits

generated by the portfolio. The transaction does not impact Target’s 5% REDcard Rewards loyalty program and will

have minimal impact on Target’s current cardholders and guests. Beginning with the first quarter of 2013, income

from the profit-sharing arrangement, net of account servicing expenses, will be recognized as an offset to selling,

general and administrative (SG&A) expenses, and we will no longer report a U.S. Credit Card Segment. Refer to

Note 7 of the Notes to the Consolidated Financial Statements included in Item 8, Financial Statements and

Supplementary Data for more information on our credit card receivables transaction.

Our Canadian Segment includes costs incurred in the U.S. and Canada related to our 2013 Canadian retail market

entry.

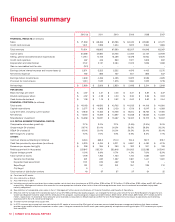

Financial Highlights

Our fiscal year ends on the Saturday nearest January 31. Unless otherwise stated, references to years in this report

relate to fiscal years, rather than to calendar years. Fiscal 2012 ended on February 2, 2013, and consisted of

53 weeks. Fiscal 2011 ended January 28, 2012, and consisted of 52 weeks. Fiscal 2010 ended January 29, 2011,

and consisted of 52 weeks. Fiscal 2013 will end on February 1, 2014, and will consist of 52 weeks.

For information on key financial highlights and segment financial information, see the items referenced in Item 6,

Selected Financial Data, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of

Operations and Item 8, Financial Statements and Supplemental Data — Note 29, Segment Reporting, of this Annual

Report on Form 10-K.

Seasonality

Due to the seasonal nature of our business, a larger share of annual revenues and earnings traditionally occurs in

the fourth quarter because it includes the peak sales period from Thanksgiving to the end of December.

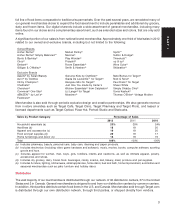

Merchandise

We sell a wide assortment of general merchandise and food in our stores. Our general merchandise and CityTarget

stores offer a food assortment on a smaller scale than traditional supermarkets, while our SuperTarget stores offer a

2