Target 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

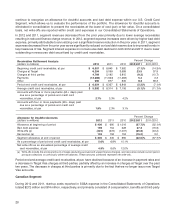

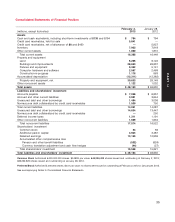

Capital Expenditures

2012 2011

Capital Expenditures (a)

(millions) U.S. Canada Total U.S. Canada Total 2010

New stores $ 673 $417 $1,090 $ 439 $1,619 $2,058 $ 574

Store remodels and

expansions 690 — 690 1,289 — 1,289 966

Information technology,

distribution and other 982 515 1,497 748 273 1,021 589

Total $2,345 $932 $3,277 $2,476 $1,892 $4,368 $2,129

(a) See Note 29 to our Consolidated Financial Statements for capital expenditures by segment.

The decrease in capital expenditures in 2012 from the prior year was primarily driven by the purchase of Zellers

leases in Canada in 2011 and fewer store remodels in the U.S. in 2012, partially offset by continued investment in

new stores in the U.S. and Canada and technology and multichannel investments. We expect approximately

$3.8 billion of capital expenditures in 2013, reflecting an estimated $2.3 billion in our U.S. Segment and

approximately $1.5 billion in our Canadian Segment.

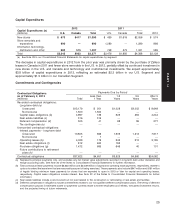

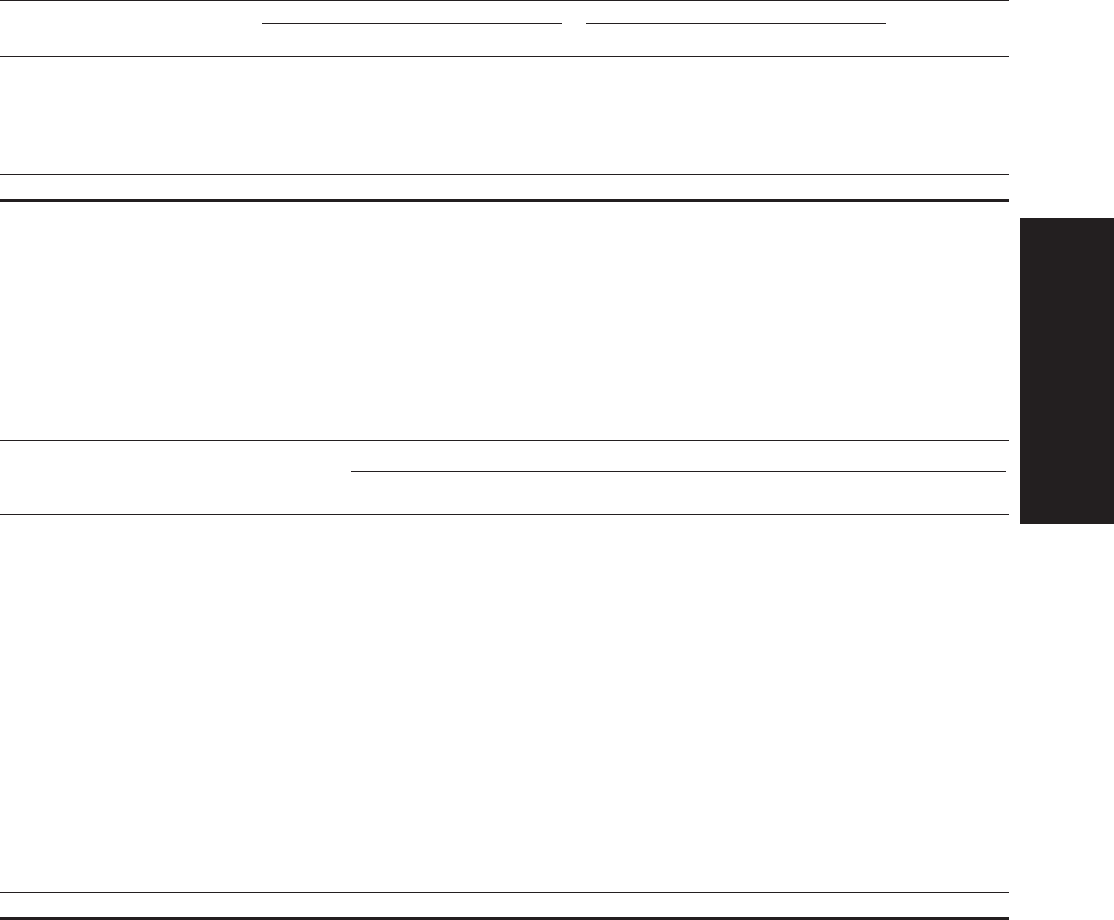

Commitments and Contingencies

Payments Due by Period

Contractual Obligations

as of February 2, 2013 Less than 1-3 3-5 After 5

(millions) Total 1 Year Years Years Years

Recorded contractual obligations:

Long-term debt (a)

Unsecured $13,179 $ 501 $1,028 $3,002 $ 8,648

Nonrecourse 1,500 1,500 — — —

Capital lease obligations (b) 4,997 136 323 294 4,244

Real estate liabilities (c) 316 316 — — —

Deferred compensation (d) 505 41 88 99 277

Tax contingencies (e) —————

Unrecorded contractual obligations:

Interest payments – long-term debt

Unsecured 10,805 666 1,309 1,213 7,617

Nonrecourse 7 7 — — —

Operating leases (b) 4,029 179 343 312 3,195

Real estate obligations (f) 812 620 192 — —

Purchase obligations (g) 1,472 685 646 40 101

Future contributions to retirement

plans (h) —————

Contractual obligations $37,622 $4,651 $3,929 $4,960 $24,082

(a) Represents principal payments only, and excludes any fair market value adjustments recorded in long-term debt under derivative and

hedge accounting rules. See Note 20 of the Notes to Consolidated Financial Statements for further information.

(b) Total contractual lease payments include $3,323 million and $2,039 million of capital and operating lease payments, respectively, related to

options to extend the lease term that are reasonably assured of being exercised. These payments also include $947 million and $181 million

of legally binding minimum lease payments for stores that are expected to open in 2013 or later for capital and operating leases,

respectively. Capital lease obligations include interest. See Note 22 of the Notes to Consolidated Financial Statements for further

information.

(c) Real estate liabilities include costs incurred but not paid related to the construction or remodeling of real estate and facilities.

(d) Deferred compensation obligations include commitments related to our nonqualified deferred compensation plans. The timing of deferred

compensation payouts is estimated based on payments currently made to former employees and retirees, forecasted investment returns,

and the projected timing of future retirements.

25

PART II