Target 2012 Annual Report Download - page 46

Download and view the complete annual report

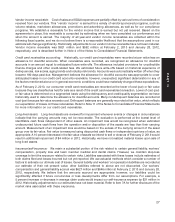

Please find page 46 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.declines in interest rates, we hold high-quality, long-duration bonds and interest rate swaps in our pension plan

trust. At year-end, we had hedged 36 percent of the interest rate exposure of our funded status.

As more fully described in Note 15 and Note 27 of the Notes to Consolidated Financial Statements, we are exposed

to market returns on accumulated team member balances in our nonqualified, unfunded deferred compensation

plans. We control the risk of offering the nonqualified plans by making investments in life insurance contracts and

prepaid forward contracts on our own common stock that offset a substantial portion of our economic exposure to

the returns on these plans. The annualized effect of a one percentage point change in market returns on our

nonqualified defined contribution plans (inclusive of the effect of the investment vehicles used to manage our

economic exposure) would not be significant.

We are exposed to market risk associated with foreign currency exchange rate fluctuations. We will be further

exposed to this risk as we commence Canadian operations during 2013. During 2012 and 2011, gains and losses

due to fluctuations in exchange rates were not significant as all stores were located in the United States, and the

vast majority of imported merchandise was purchased in U.S. dollars.

There have been no other material changes in our primary risk exposures or management of market risks since the

prior year.

30