Symantec 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

(a) During the June 2005 quarter, we reclassified our operating segments as described in Note 15, tested our

goodwill for impairment under the new segment structure, and determined that there was no impairment

of goodwill.

(b) During fiscal 2006, we adjusted the goodwill related to several prior acquisitions for individually

insignificant amounts based on final income tax returns and continued post-closing review.

Goodwill is tested for impairment on an annual basis, or earlier if indicators of impairment exist. We

completed our annual goodwill impairment test required by SFAS No. 142 during the March 2006 quarter

and determined that there was no impairment of goodwill.

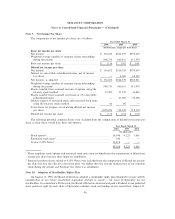

Acquired product rights, net

Acquired product rights subject to amortization are as follows:

March 31, 2006

Gross Carrying Accumulated Net Carrying

Amount Amortization Amount

(In thousands)

Developed technology ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,597,567 $(420,887) $1,176,680

Patents ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 78,713 (18,416) 60,297

Backlog and other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 60,661 (59,127) 1,534

$1,736,941 $(498,430) $1,238,511

March 31, 2005

Gross Carrying Accumulated Net Carrying

Amount Amortization Amount

(In thousands)

Developed technology ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $243,958 $(167,061) $ 76,897

Patents ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 53,559 (11,030) 42,529

Backlog and other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 14,761 (6,568) 8,193

$312,278 $(184,659) $127,619

In addition to the business combinations discussed in Note 3, we acquired Acquired product rights in the

following transactions:

On October 7, 2005, in connection with the acquisition of Sygate, we obtained certain acquired product

rights related to patent licenses held by Sygate valued at approximately $18 million. The Acquired product

rights are being amortized to Cost of revenues in the Consolidated Statements of Income over their estimated

life of twelve years.

On May 12, 2005, we resolved patent litigation matters with Altiris, Inc. by entering into a cross-licensing

agreement that resolved all legal claims between the companies. As part of the settlement, we paid Altiris

$10 million for use of the disputed technology. Under the transaction, we expensed $2 million of patent settlement

costs in the June 2005 quarter that was related to benefits received by us in and prior to the June 2005 quarter. The

remaining $8 million was recorded as Acquired product rights and is being amortized to Cost of revenues in the

Consolidated Statements of Income over the remaining life of the primary patent, which expires in May 2017.

On August 6, 2003, we purchased a security technology patent as part of a settlement in Hilgraeve, Inc. v.

Symantec Corporation. As part of the settlement, we also received licenses to the remaining patents in Hilgraeve's

portfolio. The total cost of purchasing the patent and licensing additional patents was $63 million, which was paid

in cash in August 2003. Under the transaction, we recorded $14 million of patent settlement costs in the June 2003

quarter that were related to benefits received by us in and prior to the June 2003 quarter. The remaining

$49 million was recorded as Acquired product rights and is being amortized to Cost of revenues in the

Consolidated Statements of Income over the remaining life of the primary patent, which expires in June 2011.

91