Symantec 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

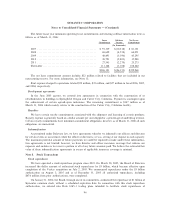

equal to the lesser of 85% of the fair market value as of the beginning of the two-year offering period or the

end of the six-month purchase period. The Board of Directors eliminated the two-year offering period in

March 2005, effective July 1, 2005. Under the ESPP, 3.9 million, 3.2 million, and 2.9 million shares were

issued during fiscal 2006, 2005, and 2004, respectively, representing $59 million, $32 million, and $23 million

in contributions, respectively. As of March 31, 2006, a total of 20.2 million shares had been issued under this

plan.

Stock award plan

2000 Director Equity Incentive Plan

In September 2000, our stockholders approved the 2000 Director Equity Incentive Plan and reserved

50,000 shares of common stock for issuance thereunder. In September 2004, stockholders increased the

number of shares of stock that may be issued by 50,000. The purpose of this plan is to provide the members of

the Board of Directors with an opportunity to receive common stock for all or a portion of the retainer payable

to each director for serving as a member. Each director may elect to receive 50% to 100% of the retainer to be

paid in the form of stock. As of March 31, 2006, a total of 58,468 shares had been issued under this plan and

41,532 shares remained available for future issuance.

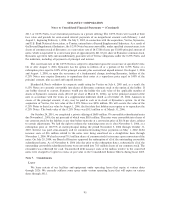

Stock option plans

We maintain stock option plans pursuant to which the Board of Directors, or a committee of the Board of

Directors, may grant incentive and nonqualified stock options to employees, officers, directors, consultants,

independent contractors, and advisors to us, or of any parent, subsidiary, or affiliate of Symantec. The purpose

of these plans is to attract, retain, and motivate eligible persons whose present and potential contributions are

important to our success by offering them an opportunity to participate in our future performance through

awards of stock options and stock bonuses. Under the terms of these plans, the option exercise price may not

be less than 100% of the fair market value on the date of grant and options generally vest over a four-year

period. Options granted prior to October 2005 generally have a maximum term of ten years and options

granted thereafter generally have a maximum term of seven years.

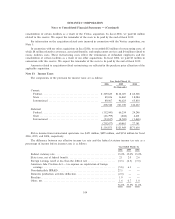

2004 and 1996 Equity Incentive Plans

In September 2004, stockholders approved the terms of the 2004 Equity Incentive Plan and reserved

18.0 million shares for issuance thereunder. An additional 9.5 million shares were transferred to this plan from

the 1996 Equity Incentive Plan upon that plan's expiration in March 2006. Under the 2004 Equity Incentive

Plan, we may grant options, stock appreciation rights, RSUs, or restricted stock awards to employees, officers,

directors, consultants, independent contractors, and advisors to us, or of any parent, subsidiary, or affiliate of

Symantec as the Board of Directors or committee may determine. A maximum of 10% of the shares reserved

under the plan may be granted in the form of restricted stock awards. Under the terms of this plan, the

Compensation Committee determines whether an option will be an incentive stock option or a non-qualified

stock option. This plan superseded the 1996 Equity Incentive Plan upon its expiration. As of March 31, 2006,

25.8 million shares remain available for future grant.

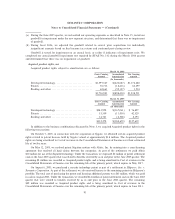

During fiscal 2006, we granted an aggregate of 200,000 RSUs to two officers. The market value of the

underlying common stock on the dates of grant was $3 million, which was recorded in Deferred stock-based

compensation within Stockholders' equity in the Consolidated Balance Sheets in fiscal 2006. The deferred

stock-based compensation is being amortized over the three to four-year vesting periods.

On October 20, 2004, we issued 200,000 restricted shares of common stock to our then-current Chief

Financial Officer, at a purchase price of $1,000 (representing the aggregate par value at the time of issuance),

vesting 50% at each anniversary date. The market value of the common stock on the date of grant, less the

purchase price, was $6 million and was recorded in Deferred stock-based compensation within Stockholders'

equity in the Consolidated Balance Sheets in fiscal 2005. Upon the retirement of the former Chief Financial

100