Symantec 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

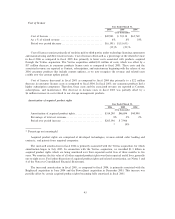

In connection with the acquisition of Brightmail in June 2004, we assumed Brightmail stock options and

converted them into options to purchase Symantec common stock. The intrinsic value of the assumed

unvested stock options was $21 million and was recorded in Deferred stock-based compensation within

Stockholders' equity in the Consolidated Balance Sheets during fiscal 2005. During the September 2004

quarter, we reduced Deferred stock-based compensation by an insignificant amount as a result of the

cancellation of a portion of those options upon employee terminations. We recorded amortization of deferred

stock-based compensation related to the assumed Brightmail stock options of $8 million in fiscal 2006 and

$3 million in fiscal 2005.

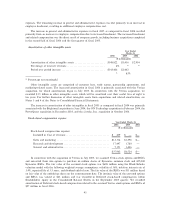

On October 20, 2004, we issued 200,000 restricted shares of common stock to our then-current Chief

Financial Officer, at a purchase price of $1,000 (representing the aggregate par value at the time of issuance),

vesting 50% at each anniversary date. The market value of the common stock on the date of grant, less the

purchase price, was $6 million and was recorded in Deferred stock-based compensation within Stockholders'

equity in the Consolidated Balance Sheets in fiscal 2005. Upon the retirement of our former Chief Financial

Officer in December 2005, 100,000 shares were forfeited and we reversed the related Deferred stock-based

compensation. We recorded amortization of deferred stock-based compensation related to the restricted shares

of $2 million in fiscal 2006 and $1 million in fiscal 2005.

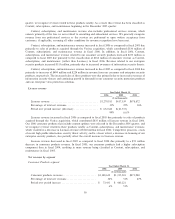

Acquired in-process research and development (IPR&D)

Year Ended March 31,

2006 2005 2004

($ in thousands)

Acquired in-process research and development ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $285,100 $3,480 $3,710

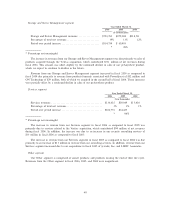

During fiscal 2006, we wrote off IPR&D totaling $285 million, of which $284 million was in connection

with our acquisition of Veritas. The IPR&D was written off because the acquired technologies had not

reached technological feasibility and had no alternative uses. Technological feasibility is defined as being

equivalent to completion of a beta-phase working prototype in which there is no remaining risk relating to the

development. At the time of the acquisition in July 2005, Veritas was developing new products in multiple

product areas that qualify as IPR&D. These efforts included NetBackup 6.1, Backup Exec 11.0, Server

Management 5.0, and various other projects. At the time of the acquisition, it was estimated that these

IPR&D development efforts would be completed over the following 12 to 18 months at an estimated total cost

of $120 million. At March 31, 2006, the development efforts were continuing on schedule and within expected

costs.

The value assigned to the Veritas IPR&D was determined by estimating costs to develop the purchased

IPR&D into commercially viable products, estimating the resulting net cash flows from the projects when

completed, and discounting the net cash flows to their present values. The revenue estimates used in the net

cash flow forecasts were based on estimates of relevant market sizes and growth factors, expected trends in

technology, and the nature and expected timing of new product introductions by Veritas and its competitors.

The rate utilized to discount the net cash flows to their present values was based on Veritas' weighted

average cost of capital. The weighted average cost of capital was adjusted to reflect the difficulties and

uncertainties in completing each project and thereby achieving technological feasibility, the percentage of

completion of each project, anticipated market acceptance and penetration, market growth rates, and risks

related to the impact of potential changes in future target markets. Based on these factors, a discount rate of

13.5% was deemed appropriate for valuing the IPR&D.

The estimates used in valuing IPR&D were based upon assumptions believed to be reasonable but which

are inherently uncertain and unpredictable. Assumptions may be incomplete or inaccurate, and unanticipated

events and circumstances may occur.

In fiscal 2005, we wrote off $3 million of IPR&D in connection with our acquisition of Brightmail. The

Brightmail IPR&D related to the third generation of Brightmail's antispam product offering. The efforts

required to develop the acquired IPR&D principally related to the completion of all planning, design,

46