Symantec 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

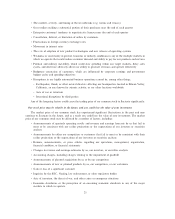

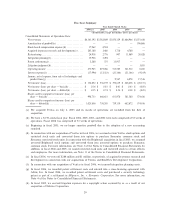

Five-Year Summary

Year Ended March 31,(b)

2006(a) 2005 2004 2003 2002

(In thousands, except net income (loss) per share)

Consolidated Statements of Operations Data:

Net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $4,143,392 $2,582,849 $1,870,129 $1,406,946 $1,071,438

Amortization of goodwill(c) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ ÌÌÌÌ196,806

Stock-based compensation expense(d)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 37,962 4,524 Ì Ì Ì

Acquired in-process research and development(e) ÏÏÏÏ 285,100 3,480 3,710 4,700 Ì

Restructuring ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 24,918 2,776 907 11,089 20,428

Integration planning(f)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 15,926 3,494 Ì Ì Ì

Patent settlement(g)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,200 375 13,917 Ì Ì

Litigation judgment(h)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ ÌÌÌÌ3,055

Operating income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 273,965 819,266 513,585 341,512 8,041

Interest expense(i) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (17,996) (12,323) (21,164) (21,166) (9,169)

Income, net of expense, from sale of technologies and

product lines(j) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 9,547 6,878 15,536

Net income (loss)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 156,852 $ 536,159 $ 370,619 $ 248,438 $ (28,151)

Net income (loss) per share Ì basic(k) ÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.16 $ 0.81 $ 0.61 $ 0.43 $ (0.05)

Net income (loss) per share Ì diluted(k) ÏÏÏÏÏÏÏÏÏÏ $ 0.15 $ 0.74 $ 0.54 $ 0.38 $ (0.05)

Shares used to compute net income (loss) per

share Ì basic(k)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 998,733 660,631 611,970 581,580 574,416

Shares used to compute net income (loss) per

share Ì diluted(k) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,025,856 738,245 719,110 682,872 574,416

(a) We acquired Veritas on July 2, 2005 and its results of operations are included from the date of

acquisition.

(b) We have a 52/53-week fiscal year. Fiscal 2006, 2005, 2003, and 2002 were each comprised of 52 weeks of

operations. Fiscal 2004 was comprised of 53 weeks of operations.

(c) Beginning in fiscal 2003, we no longer amortize goodwill due to the adoption of a new accounting

standard.

(d) In connection with our acquisition of Veritas in fiscal 2006, we assumed certain Veritas stock options and

restricted stock units and converted them into options to purchase Symantec common stock and

Symantec restricted stock units. In connection with the Brightmail acquisition in fiscal 2005, we assumed

unvested Brightmail stock options and converted them into unvested options to purchase Symantec

common stock. For more information, see Note 3 of the Notes to Consolidated Financial Statements. In

addition, in fiscal 2006 and 2005, we issued restricted stock units and restricted stock to certain officers

and employees. For more information, see Note 11 of the Notes to Consolidated Financial Statements.

(e) In fiscal 2006, we wrote off $284 million and $1 million, respectively, of acquired in-process research and

development in connection with our acquisitions of Veritas and BindView Development Corporation.

(f) In connection with our acquisition of Veritas in fiscal 2006, we incurred integration planning costs.

(g) In fiscal 2006, we recorded patent settlement costs and entered into a cross-licensing agreement with

Altiris, Inc. In fiscal 2004, we recorded patent settlement costs and purchased a security technology

patent as part of a settlement in Hilgraeve, Inc. v. Symantec Corporation. For more information, see

Note 4 of the Notes to Consolidated Financial Statements.

(h) In fiscal 2002, we accrued litigation expenses for a copyright action assumed by us as a result of our

acquisition of Delrina Corporation.

29