Symantec 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.completed the reorganization of certain international subsidiaries acquired as part of the Veritas acquisition.

This reorganization is expected to result in a rebalancing of our cash between the U.S. and foreign operations

over the next several years.

On July 2, 2005, we completed our acquisition of Veritas and acquired its cash, cash equivalents, and short-

term investments of approximately $2.9 billion and assumed contingently convertible debt with a principal

amount of $520 million due August 1, 2013 and a short-term loan with a principal amount of

EURO 411 million, which was paid in its entirety on July 7, 2005. The convertible debt may be converted by the

holders at any time into 24.37288 shares of Symantec common stock per $1,000 principal amount, which is

equivalent to a conversion price of approximately $41.03 per share of Symantec common stock. Upon

conversion, we would be required to pay the holder the cash value of the applicable number of shares of

Symantec common stock ($16.83 per share at March 31, 2006), up to the principal amount of the note.

Amounts in excess of the principal amount, if any, may be paid in cash or in stock at Symantec's option. Interest

payments of 0.25% per annum on the principal amount are payable semi-annually in arrears on February 1 and

August 1 of each year. On or after August 5, 2006, we have the option to redeem all or a portion of the notes at a

redemption price equal to the principal amount, plus accrued and unpaid interest. On August 1, 2006 and

August 1, 2008, or upon a fundamental change involving Symantec, holders have the right to require us to

repurchase the notes at a repurchase price equal to the principal amount, plus accrued and unpaid interest. The

notes are classified as a current liability in our Consolidated Balance Sheets at March 31, 2006.

During fiscal 2006, in addition to Veritas, we completed acquisitions of five privately-held companies and

one public company for $627 million in cash, including acquisition-related expenses resulting from financial

advisory, legal and accounting services, duplicate sites, and severance costs.

During April 2006, we purchased an office building of approximately 236,000 square feet in Cupertino,

California for $81 million. This property is currently leased to a third party.

We believe that our cash balances, including those assumed in the acquisition of Veritas, as well as cash

that we generate over time from our combined operations and our borrowing capacity, will be sufficient to

satisfy our anticipated cash needs for working capital and capital expenditures for at least the next 12 months.

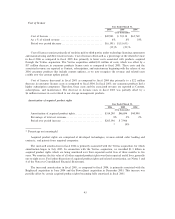

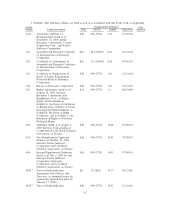

Operating Activities

Net cash provided by operating activities in fiscal 2006 resulted largely from net income of $157 million,

plus an increase in deferred revenue of $683 million, non-cash charges, primarily for depreciation and

amortization, of $678 million, and the write off of IPR&D of $285 million related to the acquisitions of Veritas

and BindView. These factors were partially offset by a decrease in deferred income taxes of $203 million and

by an increase in trade accounts receivable of $87 million. We expect operating cash flow to continue to be

positive in the future.

Net cash provided by operating activities in fiscal 2005 resulted largely from net income of $536 million,

plus non-cash depreciation and amortization charges of $132 million, the income tax benefit from employee

stock plans of $109 million, and deferred income taxes of $61 million. In addition, our deferred revenue

increased by $319 million and income taxes payable increased by $56 million.

Net cash provided by operating activities in fiscal 2004 resulted largely from net income of $371 million,

plus non-cash depreciation and amortization charges of $117 million and the income tax benefit from

employee stock plans of $67 million. Deferred revenue increased by $345 million, partially offset by an

increase in accounts receivable of $83 million. In addition, income taxes payable increased by $54 million.

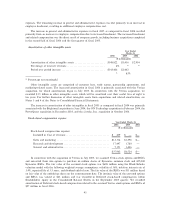

Investing Activities

Net cash provided by investing activities in fiscal 2006 was primarily the result of net sales of available-

for-sale securities of $3.4 billion and cash of $541 million acquired through the acquisition of Veritas, net of

cash expenditures for our other acquisitions in fiscal 2006. These amounts were partially offset by capital

expenditures of $267 million, including $63 million for the purchase of two buildings in Mountain View,

California.

52