Symantec 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(i) In fiscal 2006, in connection with our acquisition of Veritas, we assumed $520 million of 0.25% converti-

ble subordinated notes. In October 2001, we issued $600 million of 3% convertible subordinated notes. In

November 2004, substantially all of the outstanding 3% convertible subordinated notes were converted

into 70.3 million shares of our common stock and the remainder was redeemed for cash. For more

information, see Note 6 of the Notes to Consolidated Financial Statements.

(j) Income, net of expense, from sale of technologies and product lines primarily related to royalty payments

received in connection with the licensing of substantially all of the ACT!

TM

product line technology. In

December 2003, Interact Commerce Corporation purchased this technology from us.

(k) Share and per share amounts reflect the two-for-one stock splits effected as stock dividends, which

occurred on November 30, 2004, November 19, 2003, and January 31, 2002.

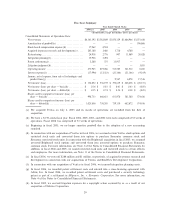

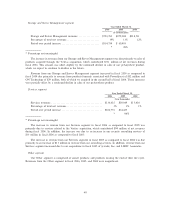

March 31,

2006 2005 2004 2003 2002

(In thousands)

Balance Sheet Data:

Working capital(l)ÏÏÏÏÏ $ 430,365 $1,987,259 $1,555,094 $1,152,773 $ 988,044

Total assets ÏÏÏÏÏÏÏÏÏÏÏ 17,913,183 5,614,221 4,456,498 3,265,730 2,502,605

Convertible subordinated

notes(m)ÏÏÏÏÏÏÏÏÏÏÏ 512,800 Ì 599,987 599,998 600,000

Long-term obligations,

less current portion ÏÏ 24,916 4,408 6,032 6,729 7,954

Stockholders' equityÏÏÏÏ 13,668,471 3,705,453 2,426,208 1,764,379 1,319,876

(l) A portion of deferred revenue as of March 31, 2003 was reclassified from current to long-term to conform

to the current presentation. Amounts prior to fiscal 2003 are considered immaterial for reclassification.

(m) In fiscal 2006, in connection with our acquisition of Veritas, we assumed $520 million of 0.25% converti-

ble subordinated notes, which are classified as a current liability and are included in the calculation of

working capital. In October 2001, we issued $600 million of 3% convertible subordinated notes. In

November 2004, substantially all of the outstanding 3% convertible subordinated notes were converted

into 70.3 million shares of our common stock and the remainder was redeemed for cash. For more

information, see Note 6 of the Notes to Consolidated Financial Statements.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

We are the world leader in providing a wide range of solutions to help individuals and enterprises assure

the security, availability, and integrity of their information technology, or IT, infrastructure as well as the

information itself. With innovative technology solutions and services, we help individuals and enterprises

protect and manage their digital assets. We provide a wide range of solutions including enterprise and

consumer security, data protection, application and infrastructure management, security management, storage

and server management, and response and managed security services. Founded in 1982, we have operations in

40 countries worldwide.

We have a 52/53-week fiscal accounting year. Accordingly, all references as of and for the periods ended

March 31, 2006, 2005, and 2004 reflect amounts as of and for the periods ended March 31, 2006, April 1,

2005, and April 2, 2004, respectively. The fiscal accounting years ended March 31, 2006 and April 1, 2005 are

each comprised of 52 weeks of operations, while the fiscal accounting year ended April 2, 2004 is comprised of

53 weeks of operations. The fiscal accounting year ending March 30, 2007 will comprise 52 weeks of

operations.

30