Symantec 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Foreign Currency Translation

The functional currency of our foreign subsidiaries is generally the local currency. Assets and liabilities

denominated in foreign currencies are translated using the exchange rate on the balance sheet dates. The

translation adjustments resulting from this process are included as a component of Stockholders' equity in

Accumulated other comprehensive income. Revenues and expenses are translated using monthly average

exchange rates prevailing during the year. Foreign currency transaction gains and losses are included Interest

and other income, net in the Consolidated Statements of Income. Deferred tax assets (liabilities) are

established on the cumulative translation adjustment attributable to unremitted foreign earnings that are not

intended to be indefinitely reinvested.

Revenue Recognition

We market and distribute our software products both as stand-alone software products and as integrated

product suites. We recognize revenue when the following conditions have been met:

‚ Persuasive evidence of an arrangement exists

‚ Delivery has occurred or services have been rendered

‚ Collection of a fixed or determinable amount is considered probable

‚ If appropriate, reasonable estimates of future product returns can be made

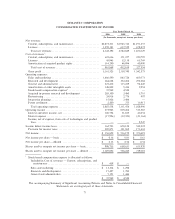

We derive revenue primarily from sales of content, subscriptions, and maintenance and licenses.

Content, subscriptions, and maintenance revenue includes arrangements for software maintenance and

technical support for our products, content and subscription services primarily related to our security products,

revenue from arrangements where vendor-specific objective evidence, or VSOE, of the fair value of

undelivered elements does not exist, and managed security services. These arrangements are generally offered

to our customers over a specified period of time and we recognize the related revenue ratably over the

maintenance, subscription, or service period.

Content, subscriptions, and maintenance revenue also includes professional services revenue, which

consists primarily of the fees we earn related to consulting and educational services. We generally recognize

revenue from professional services as the services are performed or upon written acceptance from customers, if

applicable, assuming all other conditions for revenue recognition noted above have been met.

License revenue is derived primarily from the licensing of our various products and technology. We

generally recognize license revenue upon delivery of the product, assuming all other conditions for revenue

recognition noted above have been met.

We enter into perpetual software license agreements through direct sales to customers and indirect sales

with distributors and resellers. The license agreements generally include product maintenance agreements, for

which the related revenue is included with Content, subscriptions, and maintenance and is deferred and

recognized ratably over the period of the agreements.

In arrangements that include multiple elements, including perpetual software licenses and maintenance

and/or services and packaged products with content updates, we allocate and defer revenue for the

undelivered items based on VSOE of fair value of the undelivered elements, and recognize the difference

between the total arrangement fee and the amount deferred for the undelivered items as license revenue.

VSOE of each element is based on the price for which the undelivered element is sold separately. We

determine fair value of the undelivered elements based on historical evidence of our stand-alone sales of these

elements to third parties or from the stated renewal rate for the undelivered elements. When VSOE does not

exist for undelivered items such as maintenance, the entire arrangement fee is recognized ratably over the

performance period. Our deferred revenue consists primarily of the unamortized balance of enterprise product

maintenance and consumer product content update subscriptions.

Indirect channel sales

For our Consumer Products segment, we sell packaged software products through a multi-tiered

distribution channel. We also sell electronic download and packaged products via the Internet. We separately

75