Symantec 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investment is recorded at its initial cost and is periodically evaluated for impairment. During our review for

impairment, we examine the investees' actual and forecasted operating results, financial position, and liquidity,

as well as business/industry factors in assessing whether a decline in value of an equity investment has

occurred that is other-than-temporary. When such a decline in value is identified, the fair value of the equity

investment is estimated based on the preceding factors and an impairment loss is recognized in Interest and

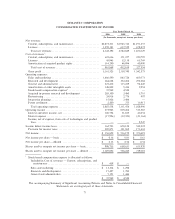

other income, net in the Consolidated Statements of Income. In fiscal 2006, 2005, and 2004, we recognized

impairment losses on our equity investments of $4 million, $1 million, and $3 million, respectively.

Each quarter we assess our compliance with accounting guidance, including the provisions of Financial

Accounting Standards Board Interpretation No., or FIN, 46R, Consolidation of Variable Interest Entities Ì

An Interpretation of ARB No. 51, and any impairment issues. Under FIN 46R, we must consolidate a variable

interest entity if we have a variable interest (or combination of variable interests) in the entity that will absorb

a majority of the entity's expected losses, receive a majority of the entity's expected residual returns, or both.

Currently, our equity investments are not subject to consolidation under FIN 46R as we do not have

significant influence over these investees and we do not receive a majority of the returns.

Derivative Financial Instruments

We utilize some natural hedging to mitigate our foreign currency exposures and we manage certain

residual exposures through the use of one-month forward foreign exchange contracts. We enter into forward

foreign exchange contracts with high-quality financial institutions primarily to minimize currency exchange

risks associated with certain balance sheet positions denominated in foreign currencies. We do not utilize

derivative instruments for trading or speculative purposes. Gains and losses on the contracts are included in

Interest and other income, net in the Consolidated Statements of Income in the period that gains and losses on

the underlying maturing forward transactions are recognized. The gains and losses on the contracts generally

offset the gains and losses on the underlying transactions. Changes in the fair value of forward foreign

exchange contracts are included in earnings. As of March 31, 2006, the notional amount of our forward

exchange contracts was $674 million, which approximates fair value due to their short time to maturity. All of

our forward exchange contracts mature in 35 days or less. We do not hedge our foreign currency translation

risk.

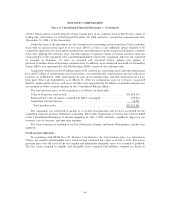

Inventories

Inventories are valued at the lower of cost or market. Cost is principally determined using currently

adjusted standards, which approximate actual cost on a first-in, first-out basis. Inventory consists of raw

materials and finished goods as well as deferred costs of revenue. Deferred costs of revenue were $41 million at

March 31, 2006 and $14 million at March 31, 2005, of which $29 million and zero, respectively, are related to

2006 consumer products that include content updates and will be recognized ratably over the term of the

subscription.

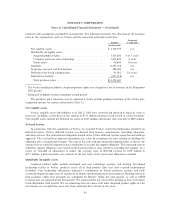

Property, Equipment, and Leasehold Improvements

Property, equipment, and leasehold improvements are stated at cost, net of accumulated depreciation and

amortization. Depreciation and amortization is provided on a straight-line basis over the estimated useful lives

of the respective assets as follows:

‚ Computer hardware and software Ì two to five years

‚ Office furniture and equipment Ì three to five years

‚ Leasehold improvements Ì the shorter of the lease term or seven years

‚ Buildings Ì twenty-five to thirty years

Capitalized Software Development Costs

Costs incurred in connection with the development of software products are accounted for in accordance

with SFAS No. 86, Accounting for the Costs of Computer Software to Be Sold, Leased or Otherwise Marketed.

Development costs incurred in the research and development of new software products and enhancements to

existing software products are expensed as incurred until technological feasibility in the form of a working

77