Symantec 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

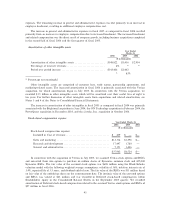

expenses. The remaining increase in general and administrative expenses was due primarily to an increase in

employee headcount, resulting in additional employee compensation cost.

The increase in general and administrative expenses in fiscal 2005 as compared to fiscal 2004 resulted

primarily from an increase in employee compensation due to increased headcount. The increased headcount

and related compensation was the direct result of company growth, including business acquisitions completed

in the second half of fiscal 2004 and the first quarter of fiscal 2005.

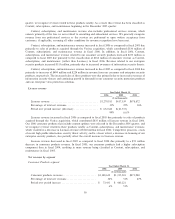

Amortization of other intangible assets

Year Ended

March 31,

2006 2005 2004

($ in thousands)

Amortization of other intangible assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $148,822 $5,416 $2,954

Percentage of total net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4% * *

Period over period increase ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $143,406 $2,462

* 83%

* Percentage not meaningful

Other intangible assets are comprised of customer base, trade names, partnership agreements, and

marketing-related assets. The increased amortization in fiscal 2006 is primarily associated with the Veritas

acquisition, for which amortization began in July 2005. In connection with the Veritas acquisition, we

recorded $1.5 billion in other intangible assets which will be amortized over their useful lives of eight to

ten years. For further discussion of other intangible assets from acquisitions and related amortization, see

Notes 3 and 4 of the Notes to Consolidated Financial Statements.

The increase in amortization of other intangibles in fiscal 2005 as compared to fiscal 2004 was primarily

associated with the Brightmail acquisition in June 2004, the ON Technology acquisition in February 2004, the

PowerQuest acquisition in December 2003, and the @stake, Inc. acquisition in October 2004.

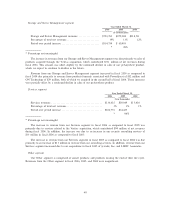

Stock-based compensation expense

Year Ended March 31,

2006 2005 2004

($ in thousands)

Stock-based compensation expense:

Included in Cost of revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 439 $ Ì $Ì

Sales and marketing ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $13,314 $1,298 $Ì

Research and development ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,497 1,780 Ì

General and administrativeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,151 1,446 Ì

$37,962 $4,524 $Ì

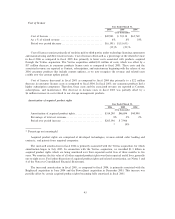

In connection with the acquisition of Veritas in July 2005, we assumed Veritas stock options and RSUs

and converted them into options to purchase 66 million shares of Symantec common stock and 425,000

Symantec RSUs. The fair value of the assumed stock options was $688 million using the Black-Scholes

valuation model with the following weighted average assumptions: volatility of 36%, risk-free interest rate of

3.4%, expected life of 3.5 years, and dividend yield of zero. The fair value of the RSUs was $11 million based

on fair value of the underlying shares on the announcement date. The intrinsic value of the unvested options

and RSUs was valued at $63 million and was recorded in Deferred stock-based compensation within

Stockholders' equity in the Consolidated Balance Sheets in the September 2005 quarter. We recorded

amortization of Deferred stock-based compensation related to the assumed Veritas stock options and RSUs of

$27 million in fiscal 2006.

45