Symantec 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

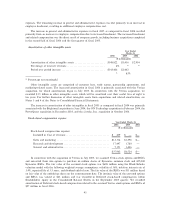

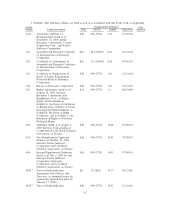

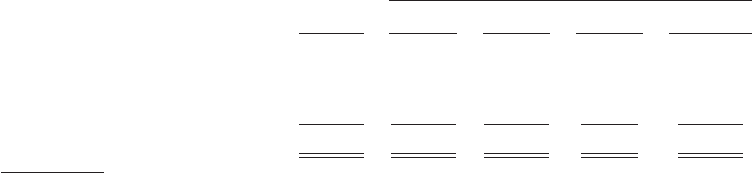

in the table below. The following table summarizes our fixed contractual obligations and commitments as of

March 31, 2006:

Payments Due In

Total

Payments Fiscal 2008 Fiscal 2010 Fiscal 2012

Due Fiscal 2007 and 2009 and 2011 and thereafter

(In thousands)

Convertible subordinated notes1ÏÏ $520,000 $520,000 $ Ì $ Ì $ Ì

Purchase obligations2ÏÏÏÏÏÏÏÏÏÏÏ 32,850 32,850 Ì Ì Ì

Operating leases3ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 386,121 91,339 117,100 66,334 111,348

Total contractual obligations ÏÏÏ $938,971 $644,189 $117,100 $66,334 $111,348

1Convertible subordinated notes, due August 1, 2013, assumed in connection with the Veritas acquisition. On

or after August 5, 2006, Symantec has the option to redeem all or a portion of the 0.25% Notes at a

redemption price equal to 100% of the principal amount, plus accrued and unpaid interest. On August 1,

2006 and August 1, 2008, or upon the occurrence of a fundamental change involving Symantec, holders of

the 0.25% Notes may require Symantec to repurchase their notes at a purchase price equal to 100% of the

principal amount, plus accrued and unpaid interest.

2Represents amounts associated with agreements that are enforceable, legally binding, and specify terms.

3Includes $22 million related to facilities included in our restructuring reserve.

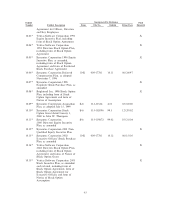

Development agreements

In the June 2005 quarter, we entered into agreements in connection with the construction of, or

refurbishments to, buildings in Springfield, Oregon and Culver City, California. Payment is contingent upon

the achievement of certain agreed-upon milestones. The remaining commitment is $147 million as of

March 31, 2006 which mainly relates to the construction of the Culver City, California facility.

Royalties

We have certain royalty commitments associated with the shipment and licensing of certain products.

Royalty expense is generally based on a dollar amount per unit shipped or a percentage of underlying revenue

and has not been included in the table above. Certain royalty commitments have minimum commitment

obligations; however, as of March 31, 2006, all such obligations are immaterial.

Indemnification

As permitted under Delaware law, we have agreements whereby we indemnify our officers and directors

for certain events or occurrences while the officer or director is, or was, serving at our request in such capacity.

The maximum potential amount of future payments we could be required to make under these indemnifica-

tion agreements is not limited; however, we have director and officer insurance coverage that reduces our

exposure and enables us to recover a portion or all of any future amounts paid. We believe the estimated fair

value of these indemnification agreements in excess of applicable insurance coverage is minimal.

Newly Adopted And Recently Issued Accounting Pronouncements

In February 2006, the Financial Accounting Standards Board, or FASB, issued SFAS No. 155,

Accounting for Certain Hybrid Financial Instruments, which amends SFAS No. 133, Accounting for

Derivative Instruments and Hedging Activities, and SFAS No. 140, Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities. SFAS No. 155 simplifies the accounting for certain

derivatives embedded in other financial instruments by allowing them to be accounted for as a whole if the

holder elects to account for the entire instrument on a fair value basis. SFAS No. 155 also clarifies and

amends certain other provisions of SFAS No. 133 and SFAS No. 140. SFAS No. 155 is effective for all

financial instruments acquired, issued or subject to a remeasurement event occurring in fiscal years beginning

54