Symantec 2006 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

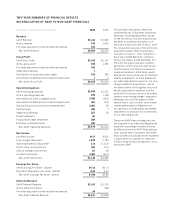

TWO YEAR SUMMARY OF FINANCIAL RESULTS

The non-GAAP information reflects the

combined results of Symantec and Veritas

Software, including adjustments based

on the fair values of assets acquired and

liabilities assumed by Symantec as of

the actual acquisition date of July 2, 2005.

For comparative purposes, the information

presented assumes that the acquisition

took place on April 1, 2004. Symantec’s

fiscal years ended March 31st whereas

Veritas’ fiscal years ended December 31st.

The 2005 fiscal year amounts combine

Symantec’s 2005 fiscal year with Veritas’

2004 fiscal year. The 2006 fiscal amounts

combine Symantec’s 2006 fiscal results

with Veritas’ historical results for the three

months ended March 31, 2005. Additional

non-GAAP adjustments consist of: non-cash

charges related to acquisitions, such as

the amortization of intangibles and stock-

based compensation expense, and the

write-off of in-process research and devel-

opment; restructuring charges; integration

planning costs; and the impact of other

special items, such as other stock-based

compensation expense, litigation mat-

ters, gain / loss on investments and related

adjustments to provision for income taxes,

on our operating results.

These non-GAAP financial measures are

not prepared in accordance with generally

accepted accounting principles and may

be different from non-GAAP financial mea-

sures used by other companies. Non-GAAP

financial measures should not be considered

a substitute for, or superior to, measures

of financial performance prepared in accor-

dance with GAAP.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIALS

(in millions, except per share amounts) 2006 2005

Revenue

GAAP Revenue $ 4,143 $ 2,583

Veritas revenue 559 2,042

Fair value adjustment to Veritas deferred revenue 302 -

Non-GAAP Revenue $ 5,004 $ 4,625

Gross Profit

GAAP Gross Profit $ 3,162 $ 2,131

Veritas gross profit 398 1,396

Fair value adjustment to Veritas deferred revenue 302 -

Integration planning 1 -

Amortization of acquired product rights 386 383

Amortization of deferred stock-based compensation 1 4

Non-GAAP Gross Profit $ 4,250 $ 3,914

Operating Expenses

GAAP Operating Expenses $ 2,888 $ 1,311

Veritas operating expenses 400 1,338

Amortization of other intangible assets (196) (193)

Amortization of deferred stock-based compensation (43) (24)

Acquired in-process research and development (285) (3)

Restructuring (25) 7

Integration planning (27) (3)

Patent settlement (2) -

Proposed SEC legal settlement (30) -

Executive incentive bonuses (10) -

Non-GAAP Operating Expenses $ 2,670 $ 2,433

Net Income

GAAP Net Income $ 157 $ 536

Gross margin adjustment 1,089 1,783

Operating expenses adjustment 218 (1,122)

Veritas other income and tax (12) (31)

Gain on strategic investments (1) (9)

Income tax provision (306) (111)

Non-GAAP Net Income $ 1,145 $ 1,046

Earnings Per Share

GAAP Earnings Per Share - diluted $ 0.15 $ 0.74

Non-GAAP adjustments per share - diluted 0.85 0.12

Non-GAAP Earnings Per Share - diluted $ 1.00 $ 0.86

Deferred Revenue

GAAP Deferred Revenue $ 2,163 $ 1,330

Veritas deferred revenue - 548

Fair value adjustment to Veritas deferred revenue 58 -

Non-GAAP Deferred Revenue $ 2,221 $ 1,878