Symantec 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

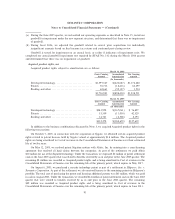

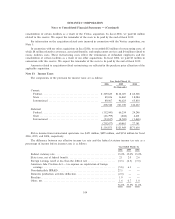

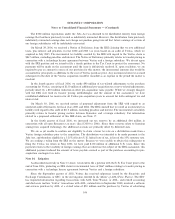

The future fiscal year minimum operating lease commitments and existing sublease information were as

follows as of March 31, 2006:

Lease Sublease Net Lease

Commitment Income Commitment

(In thousands)

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 91,339 $(10,218) $ 81,121

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 68,609 (4,558) 64,051

2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 48,491 (3,196) 45,295

2010 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 38,791 (2,803) 35,988

2011 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 27,543 (2,270) 25,273

ThereafterÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 111,348 (3,108) 108,240

$386,121 $(26,153) $359,968

The net lease commitment amount includes $22 million related to facilities that are included in our

restructuring reserve. For more information, see Note 12.

Rent expense charged to operations totaled $70 million, $35 million, and $27 million in fiscal 2006, 2005,

and 2004, respectively.

Development agreements

In the June 2005 quarter, we entered into agreements in connection with the construction of or

refurbishments to buildings in Springfield, Oregon and Culver City, California. Payment is contingent upon

the achievement of certain agreed-upon milestones. The remaining commitment is $147 million as of

March 31, 2006 which mainly relates to the construction of the Culver City, California facility.

Royalties

We have certain royalty commitments associated with the shipment and licensing of certain products.

Royalty expense is generally based on a dollar amount per unit shipped or a percentage of underlying revenue.

Certain royalty commitments have minimum commitment obligations; however, as of March 31, 2006 all such

obligations are immaterial.

Indemnification

As permitted under Delaware law, we have agreements whereby we indemnify our officers and directors

for certain events or occurrences while the officer or director is, or was, serving at our request in such capacity.

The maximum potential amount of future payments we could be required to make under these indemnifica-

tion agreements is not limited; however, we have director and officer insurance coverage that reduces our

exposure and enables us to recover a portion or all of any future amounts paid. We believe the estimated fair

value of these indemnification agreements in excess of applicable insurance coverage is minimal.

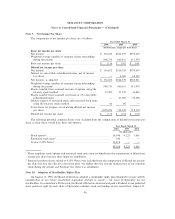

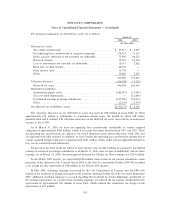

Note 8. Stock Transactions

Stock repurchases

We have operated a stock repurchase program since 2001. On March 28, 2005, the Board of Directors

increased the dollar amount of authorized stock repurchases by $3 billion, which became effective upon

completion of the Veritas acquisition on July 2, 2005. We commenced repurchases under the $3 billion

authorization on August 2, 2005 and as of December 31, 2005 all authorized repurchases, including

$474 million from prior authorizations, were completed.

On January 31, 2006, the Board, through one of its committees, authorized the repurchase of $1 billion of

Symantec common stock, without a scheduled expiration date. In connection with this stock repurchase

authorization, we entered into Rule 10b5-1 trading plans intended to facilitate stock repurchases of

96