Symantec 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.lead to greater risks than use of third party commercial software, as open source licensors generally do not

provide warranties or controls on origin of the software. We have established processes to help alleviate these

risks, including a review process for screening requests from our development organizations for the use of open

source, but we cannot be sure that all open source is submitted for approval prior to use in our products. In

addition, many of the risks associated with usage of open source cannot be eliminated, and could, if not

properly addressed, negatively affect our business.

Our software products and website may be subject to intentional disruption that could adversely impact

our reputation and future sales.

Although we believe we have sufficient controls in place to prevent intentional disruptions, we expect to

be an ongoing target of attacks specifically designed to impede the performance of our products. Similarly,

experienced computer programmers may attempt to penetrate our network security or the security of our

website and misappropriate proprietary information or cause interruptions of our services. Because the

techniques used by such computer programmers to access or sabotage networks change frequently and may

not be recognized until launched against a target, we may be unable to anticipate these techniques. Our

activities could be adversely affected and our reputation and future sales harmed if these intentionally

disruptive efforts are successful.

Increased customer demands on our technical support services may adversely affect our relationships with

our customers and our financial results.

We offer technical support services with many of our products. We may be unable to respond quickly

enough to accommodate short-term increases in customer demand for support services. We also may be

unable to modify the format of our support services to compete with changes in support services provided by

competitors or successfully integrate support for our customers. Further customer demand for these services,

without corresponding revenues, could increase costs and adversely affect our operating results.

We have outsourced a substantial portion of our worldwide consumer support functions to third party

service providers. If these companies experience financial difficulties, do not maintain sufficiently skilled

workers and resources to satisfy our contracts, or otherwise fail to perform at a sufficient level under these

contracts, the level of support services to our customers may be significantly disrupted, which could materially

harm our relationships with these customers.

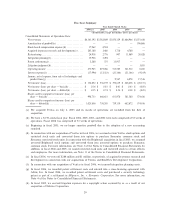

Accounting charges may cause fluctuations in our quarterly financial results.

Our financial results have been in the past, and may continue to be in the future, materially affected by

non-cash and other accounting charges, including:

‚ Amortization of intangible assets, including acquired product rights

‚ Impairment of goodwill

‚ Stock-based compensation expense, including charges related to our adoption in the first quarter of

fiscal 2007 of Statement of Financial Accounting Standards No. 123R, Share-Based Payment, which

will materially increase the stock-based compensation expense included in our results of operations

‚ Restructuring charges and reversals of those charges

‚ Impairment of long-lived assets

For example, in connection with our acquisition of Veritas, we have recorded approximately $2.8 billion

of intangible assets, including acquired product rights, and $8.6 billion of goodwill. We have recorded and will

continue to record future amortization charges with respect to a portion of these intangible assets and stock-

based compensation expense related to the stock options to purchase Veritas common stock assumed by us. In

addition, we will evaluate our long-lived assets, including property and equipment, goodwill, acquired product

rights, and other intangible assets, whenever events or circumstances occur which indicate that these assets

might be impaired. Goodwill is evaluated annually for impairment in the fourth quarter of each fiscal year or

23