Symantec 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with the IRS position and we intend to file a timely petition to the Tax Court to protest the assessment. No

payments will be made on the assessment until the issue is definitively resolved. If, upon resolution, we are

required to pay an amount in excess of our provision for this matter, the incremental amounts due would be

accounted for principally as additions to the Veritas purchase price as an increase to goodwill. Any

incremental interest accrued subsequent to the date of the Veritas acquisition would be recorded as an expense

in the period the matter is resolved.

In the fourth quarter of fiscal 2006, we made $90 million of tax-related adjustments to the purchase

accounting for Veritas, consisting of $120 million of additional pre-acquisition tax reserve-related adjustments,

partially offset by a $30 million reduction in other pre-acquisition taxes payable. While we strongly disagree

with the IRS over both its transfer pricing methodologies and the amount of the assessment, we have

established additional tax reserves for all Veritas pre-acquisition years to account for both contingent tax and

interest risk.

On March 30, 2006, we received notices of proposed adjustment from the IRS with regard to an

unrelated audit of Symantec for fiscal years 2003 and 2004. The IRS claimed that we owed an incremental tax

liability with regard to this audit of $110 million, excluding penalties and interest. The incremental tax liability

primarily relates to transfer pricing matters between Symantec and a foreign subsidiary. On June 2, 2006, we

reached an agreement in principle with the IRS to settle the IRS claims relating to this audit for $36 million,

excluding interest. The consolidated financial statements presented in this annual report reflect adequate

accruals to address this settlement amount. We anticipate that we will finalize this settlement with the IRS

before the end of June 2006.

In the fourth quarter of fiscal 2006, we increased our tax reserves by an additional $64 million in

connection with all open Symantec tax years (fiscal 2003 to 2006). Since these reserves relate to licensing

arising from acquired technology, the additional accruals are primarily offset by deferred taxes.

We are as yet unable to confirm our eligibility to claim a lower tax rate on a distribution made from a

Veritas foreign subsidiary prior to the acquisition. The distribution was intended to be made pursuant to the

Jobs Act, and therefore eligible for a 5.25% effective U.S. federal rate of tax, in lieu of the 35% statutory rate.

We are seeking a ruling from the IRS on the matter. Because we were unable to obtain this ruling prior to

filing the Veritas tax return in May 2006, we have paid $130 million of additional U.S. taxes. Since this

payment relates to the taxability of foreign earnings that are otherwise the subject of the IRS assessment, this

additional payment reduced the amount of taxes payable accrued as part of the purchase accounting for pre-

acquisition contingent tax risks. For further information, see Note 13 of the Notes to Consolidated Financial

Statements and Critical Accounting Estimates Ì Income Taxes above.

LIQUIDITY AND CAPITAL RESOURCES

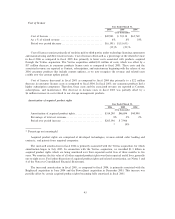

Year Ended March 31,

2006 2005 2004

(In thousands)

Net cash provided by (used for):

Operating activities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1,536,896 $1,207,459 $ 902,605

Investing activitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,619,605 (663,159) (795,598)

Financing activities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (3,910,064) (31,990) 129,154

Effect of exchange rate fluctuations on cash and cash

equivalents ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (22,248) 18,261 30,095

Net change in cash and cash equivalentsÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,224,189 530,571 266,256

As of March 31, 2006, our principal source of liquidity was our existing cash, cash equivalents, and short-

term investments of $2.9 billion, of which 28% was held domestically and the remainder was held outside of

the U.S. The remittance back to the U.S. of cash, cash equivalents, and short-term investments held by legal

entities domiciled outside of the U.S. may result in significant additional income tax expense. Accordingly, we

may choose to enhance our domestic cash position through third-party financing arrangements. We recently

51