Symantec 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

These allocations are preliminary pending the finalization of various estimates and the analysis of income

taxes. The amounts allocated to Acquired product rights are being amortized to Cost of revenues in the

Consolidated Statements of Income over their useful lives of four to five years. The amounts allocated to

Other intangible assets are being amortized to Operating expenses in the Consolidated Statements of Income

over their useful lives of one to eight years. The IPR&D was written off on the acquisition date.

Fiscal 2005 Acquisitions

During fiscal 2005, we acquired five privately-held companies for a total purchase price of $461 million,

including acquisition-related expenses resulting from financial advisory, legal and accounting services,

duplicate sites, and severance costs. The purchase price consisted of $439 million in cash and assumed stock

options valued at $22 million. We recorded goodwill in connection with each of these acquisitions. In each

acquisition, goodwill resulted primarily from our expectation of synergies from the integration of the acquired

company's technology with our technology and the acquired company's access to our global distribution

network. In addition, each acquired company provided a knowledgeable and experienced workforce. The

results of operations of the acquired companies have been included in our operations from the dates of

acquisition. Brightmail Incorporated, TurnTide, Inc., and Platform Logic, Inc. are included in our Enterprise

Security segment and @stake, Inc. and LIRIC Associates are included in our Services segment. Details of the

purchase price allocations related to our fiscal 2005 acquisitions are included in the table below. Our fiscal

2005 acquisitions were considered insignificant for pro forma financial disclosure, both individually and in the

aggregate.

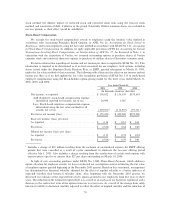

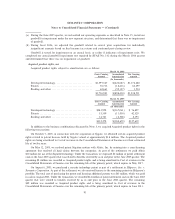

Platform

Brightmail TurnTide @stake LIRIC Logic Total

(In thousands)

Acquisition date ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ June 21, 2004 July 7, 2004 Oct 7, 2004 Oct 11, 2004 Dec 9, 2004

Net tangible assets (liabilities)ÏÏÏ $ 23,999 $ (305) $ 4,201 $ 617 $ (221) $ 28,291

Acquired product rightsÏÏÏÏÏÏÏÏÏ 40,020 4,200 9,200 540 3,900 57,860

Other intangible assetsÏÏÏÏÏÏÏÏÏÏ 8,439 60 11,100 6,475 50 26,124

IPR&D ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,480 Ì Ì Ì Ì 3,480

Goodwill ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 226,959 25,933 21,082 9,300 27,206 310,480

Deferred tax asset (liability), net 14,805 (1,704) 3,454 (2,105) (599) 13,851

Deferred stock-based

compensation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 21,339 Ì Ì Ì Ì 21,339

Total purchase price ÏÏÏÏÏÏÏÏÏÏÏ $ 339,041 $ 28,184 $ 49,037 $ 14,827 $ 30,336 $461,425

The amounts allocated to Acquired product rights are being amortized to Cost of revenues in the

Consolidated Statements of Income over their estimated lives of one to five years. The amounts allocated to

Other intangible assets are being amortized to Operating expenses in the Consolidated Statements of Income

over their estimated lives of one to eight years. The Deferred stock-based compensation is being amortized to

Operating expenses over the remaining service periods of one to four years. The IPR&D was written off on the

acquisition date.

89