Symantec 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

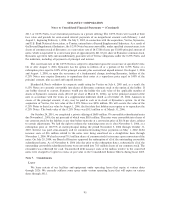

1998. The rights are initially attached to Symantec common stock and will not trade separately. If a person or

a group, an Acquiring Person, acquires 20% or more of our common stock, or announces an intention to make

a tender offer for 20% or more of our common stock, the rights will be distributed and will thereafter trade

separately from the common stock.

If the rights become exercisable, each right (other than rights held by the Acquiring Person) will entitle

the holder to purchase, at a price equal to the exercise price of the right, a number of shares of our common

stock having a then-current value of twice the exercise price of the right. If, after the rights become

exercisable, we agree to merge into another entity or we sell more than 50% of our assets, each right will entitle

the holder to purchase, at a price equal to the exercise price of the right, a number of shares of common stock

of such entity having a then-current value of twice the exercise price.

We may exchange the rights at a ratio of one share of common stock for each right (other than the

Acquiring Person) at any time after an Acquiring Person acquires 20% or more of our common stock but

before such person acquires 50% or more of our common stock. We may also redeem the rights at our option

at a price of $0.001 per right at any time before an Acquiring Person has acquired 20% or more of our common

stock. The rights will expire on August 12, 2008.

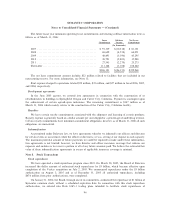

Note 11. Employee Benefits

401(k) plan

We maintain a salary deferral 401(k) plan for all of our domestic employees. This plan allows employees

to contribute up to 50% of their pretax salary up to the maximum dollar limitation prescribed by the Internal

Revenue Code. We match 50% of the employee's contribution. The maximum match in any given plan year is

the lower of 3% of the employees' eligible compensation or $6,000. Our contributions under the plan were

$14 million, $8 million, and $7 million in fiscal 2006, 2005, and 2004, respectively.

Stock purchase plans

2002 Executive Officers' Stock Purchase Plan

In September 2002, our stockholders approved the 2002 Executive Officers' Stock Purchase Plan and

reserved 250,000 shares of common stock for issuance thereunder, of which no shares are subject to

adjustment pursuant to changes in capital. The purpose of the plan is to provide executive officers with a

means to acquire an equity interest in Symantec at fair market value by applying a portion or all of their

respective bonus payments towards the purchase price. Each executive officer may purchase up to

10,000 shares in any fiscal year. As of March 31, 2006, 25,413 shares have been issued under the plan and

224,587 shares remain available for future issuance. Shares reserved for issuance under this plan have not been

adjusted for the stock dividends.

1998 Employee Stock Purchase Plan

In September 1998, our stockholders approved the 1998 Employee Stock Purchase Plan, or ESPP, and

reserved 4.0 million shares of common stock for issuance thereunder. In September 1999, the ESPP was

amended by our stockholders to increase the shares available for issuance by 6.1 million and to add an

""evergreen'' provision whereby the number of shares available for issuance increased automatically on January

1 of each year (beginning in 2000) by 1% of our outstanding shares of common stock on each immediately

preceding December 31 during the term of the plan. In July 2004, the Board of Directors eliminated this

provision. As of March 31, 2006, 18.4 million shares remain available for issuance under the plan.

Subject to certain limitations, our employees may elect to have 2% to 10% of their compensation withheld

through payroll deductions to purchase shares of common stock under the ESPP. Employees purchase shares

of common stock at a price per share equal to 85% of the fair market value on the purchase date at the end of

each six-month purchase period. For purchases prior to July 1, 2005, employees purchased shares at a price

99