Symantec 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

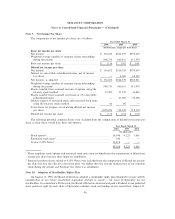

$125 million per quarter during fiscal 2007. We used $154 million of the authorized amount to repurchase

shares in the open market in the March 2006 quarter and we intend to use the remaining amount to make

stock repurchases under Rule 10b5-1 trading plans and opportunistically in fiscal 2007.

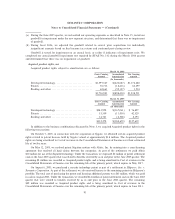

In fiscal 2006, we repurchased 174 million shares at prices ranging from $15.83 to $23.85 for an aggregate

amount of $3.6 billion. In fiscal 2005, we repurchased eight million shares at prices ranging from $21.05 to

$30.77 per share, for an aggregate amount of $192 million. In fiscal 2004, we repurchased three million shares

at prices ranging from $19.52 to $20.82 per share, for an aggregate amount of $60 million. As of March 31,

2006, $846 million remained authorized for future repurchases.

Stock dividends

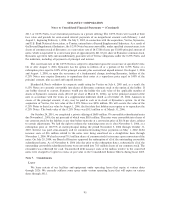

On October 19, 2004, our Board of Directors approved a two-for-one stock split to be effected in the form

of a stock dividend. Stockholders of record at the close of business on November 11, 2004 were issued one

additional share of common stock for each share owned as of that date. An additional 353 million shares

resulting from the stock dividend were issued in book-entry form on November 30, 2004.

On October 22, 2003, our Board of Directors approved a two-for-one stock split to be effected in the form

of a stock dividend. Stockholders of record at the close of business on November 5, 2003 were issued one

additional share of common stock for each share owned as of that date. An additional 154 million shares

resulting from the stock dividend were issued in book-entry form on November 19, 2003.

Increase to authorized shares

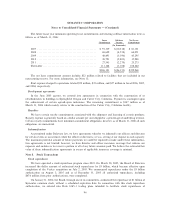

On June 24, 2005, our stockholders approved the adoption of our amended and restated certificate of

incorporation, which increased the number of authorized shares of common stock to 3,000,000,000 from

1,600,000,000. The increase was sought in order to carry out our acquisition of Veritas. On September 15,

2004, our stockholders approved the adoption of our amended and restated certificate of incorporation, which

increased the number of authorized shares of common stock to 1,600,000,000 from 900,000,000.

97