Symantec 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

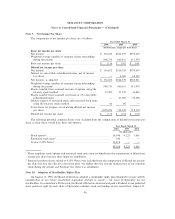

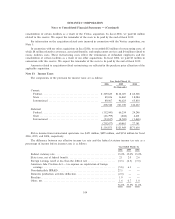

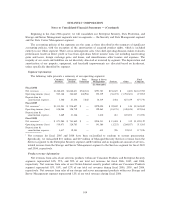

The principal components of deferred tax assets are as follows:

March 31,

2006 2005

(In thousands)

Deferred tax assets:

Tax credit carryforwards ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 45,911 $ 8,497

Net operating loss carryforwards of acquired companiesÏÏÏÏÏÏÏÏÏÏÏÏÏ 274,103 73,313

Other accruals and reserves not currently tax deductible ÏÏÏÏÏÏÏÏÏÏÏÏ 75,905 46,233

Deferred revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 18,503 16,336

Loss on investments not currently tax deductible ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 18,313 2,582

Book over tax depreciation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 48,021 Ì

State income taxesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 13,738 Ì

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 38,488 5,326

532,982 152,287

Valuation allowanceÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (66,324) (7,125)

Deferred tax assetsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 466,658 145,162

Deferred tax liabilities:

Acquired intangible assetsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (688,857) (27,001)

Tax over book depreciationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (12,086)

Unremitted earnings of foreign subsidiaries ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (125,996) (95,033)

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,376) (2,376)

Net deferred tax (liabilities) assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(350,571) $ 8,666

The valuation allowance on our deferred tax assets increased by $59 million in fiscal 2006, of which

approximately $58 million is attributable to acquisition-related assets, the benefit of which will reduce

goodwill when and if realized. The valuation allowance on our deferred tax assets increased by an immaterial

amount in fiscal 2005.

As of March 31, 2006, we have net operating loss carryforwards attributable to various acquired

companies of approximately $485 million, which, if not used, will expire between fiscal 2007 and 2025. These

net operating loss carryforwards are subject to an annual limitation under Internal Revenue Code Û382, but

are expected to be fully realized. In addition, we have foreign net operating loss carryforwards attributable to

various acquired foreign companies of approximately $561 million, which, under current applicable foreign tax

law, can be carried forward indefinitely.

No provision has been made for federal or state income taxes on $821 million of cumulative unremitted

earnings of certain of our foreign subsidiaries as of March 31, 2006, since we plan to indefinitely reinvest these

earnings. As of March 31, 2006, the unrecognized deferred tax liability for these earnings was $234 million.

In the March 2005 quarter, we repatriated $500 million from certain of our foreign subsidiaries under

provisions of the American Jobs Creation Act of 2004, or the Jobs Act, enacted in October 2004. We recorded

a tax charge for this repatriation of $54 million in the March 2005 quarter.

In May 2005, clarifying language was issued by the U.S. Department of Treasury and the IRS with

respect to the treatment of foreign taxes paid on the earnings repatriated under the Jobs Act and in September

2005, additional clarifying language was issued regarding the treatment of certain deductions attributable to

the earnings repatriation. As a result of this clarifying language, we reduced the tax expense attributable to the

repatriation by approximately $21 million in fiscal 2006, which reduced the cumulative tax charge on the

repatriation to $33 million.

105