Symantec 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

Market for Our Common Stock

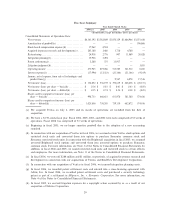

Our common stock is traded on the Nasdaq National Market under the symbol ""SYMC.'' The high and

low sales prices set forth below are as reported on the Nasdaq National Market. All sales prices have been

adjusted to reflect the two-for-one stock split, effected as a stock dividend, that became effective Novem-

ber 30, 2004.

Fiscal 2006 Fiscal 2005

Mar. 31, Dec. 31, Sep. 30, Jun. 30, Mar. 31, Dec. 31, Sep. 30, Jun. 30,

2006 2005 2005 2005 2005 2004 2004 2004

High ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $19.94 $24.01 $24.38 $22.90 $26.60 $34.05 $27.68 $25.44

Low ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $15.30 $16.32 $19.63 $18.01 $20.05 $23.53 $20.00 $19.71

As of March 31, 2006, there were approximately 5,000 stockholders of record of Symantec common

stock. Symantec has never declared or paid any cash dividends on its capital stock. We currently intend to

retain future earnings for use in our business, and, therefore, we do not anticipate paying any cash dividends on

our capital stock in the foreseeable future.

Repurchases of Our Equity Securities

Stock repurchases during the three-month period ended March 31, 2006 were as follows:

Dollar Value of Shares

Total Number of Shares That May Yet Be

Total Number of Average Price Purchased Under Publicly Purchased Under the Plans

Shares Purchased Paid per Share Announced Plans or Programs or Programs

(In millions)

December 31, 2005 to

January 27, 2006ÏÏÏÏ Ì $ Ì Ì $1,000

January 28, 2006 to

February 24, 2006ÏÏÏ 5,225,000 $17.43 5,225,000 $ 909

February 25, 2006 to

March 31, 2006ÏÏÏÏÏ 3,909,600 $16.09 3,909,600 $ 846

TotalÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,134,600 $16.85 9,134,600

We have operated a stock repurchase program since 2001. On March 28, 2005, the Board of Directors

increased the dollar amount of authorized stock repurchases by $3 billion, which became effective upon

completion of the Veritas acquisition on July 2, 2005. We commenced repurchases under the $3 billion

authorization on August 2, 2005 and as of December 31, 2005 all authorized repurchases, including

$474 million from prior authorizations, were completed.

On January 31, 2006, the Board, through one of its committees, authorized the repurchase of $1 billion of

Symantec common stock, without a scheduled expiration date. In connection with this stock repurchase

authorization, we entered into Rule 10b5-1 trading plans intended to facilitate stock repurchases of

$125 million per quarter during fiscal 2007. We used $154 million of the authorized amount to repurchase

shares in the open market in the March 2006 quarter and we intend to use the remaining amount to make

stock repurchases under Rule 10b5-1 trading plans and opportunistically in fiscal 2007.

In fiscal 2006, we repurchased 174 million shares at prices ranging from $15.83 to $23.85 for an aggregate

amount of $3.6 billion. In fiscal 2005, we repurchased eight million shares at prices ranging from $21.05 to

$30.77 per share, for an aggregate amount of $192 million. In fiscal 2004, we repurchased three million shares

at prices ranging from $19.52 to $20.82 per share, for an aggregate amount of $60 million. As of March 31,

2006, $846 million remained authorized for future repurchases.

27