Symantec 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

development, and testing activities that were necessary to establish that the product could be produced to meet

its design specifications, including features, functions, and performance. We determined the fair value of the

acquired IPR&D by estimating the projected cash flows related to the projects and future revenues to be

earned upon commercialization of the products. We discounted the resulting net cash flows to their present

values. We based the net cash flows from such projects on our analysis of the respective markets and estimates

of revenues and operating profits related to these projects.

In fiscal 2004, we wrote off $4 million of IPR&D in connection with our acquisitions of ON Technology,

PowerQuest, and Nexland. The in-process technology acquired in the ON Technology acquisition consisted

primarily of research and development related to its next generation CCM/iCommand and iPatch

TM

products,

which enable organizations and service providers to manage the full lifecycle of their computing systems over

corporate networks. We are using this technology in order to construct a common platform for our Storage and

Server Management segment products. The in-process technology acquired in the PowerQuest acquisition

consisted primarily of research and development related to its Virtual Volume Imaging technology, which

provides the capability to recover from server or desktop failures and minimize system downtime. We have

integrated this technology into our Storage and Server Management segment product offerings. The in-process

technology acquired in the Nexland acquisition consisted primarily of research and development related to a

next generation firewall product. We integrated this technology into our firewall and appliance series of

products within our Enterprise Security segment.

The efforts required to develop the ON Technology, PowerQuest, and Nexland acquired in-process

technology principally related to the completion of all planning, design, development, and test activities that

were necessary to establish that the product or service can be produced to meet its design specifications

including features, functions, and performance. We determined the fair value of the acquired in-process

technology by estimating the projected cash flows related to these projects and future revenues to be earned

upon commercialization of the products. We discounted the resulting net cash flows to their present values.

We based the net cash flows from such projects on our analysis of the respective markets and estimates of

revenues and operating profits related to these projects.

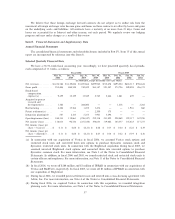

Restructuring

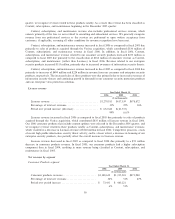

Year Ended March 31,

2006 2005 2004

($ in thousands)

Restructuring ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $24,918 $2,776 $907

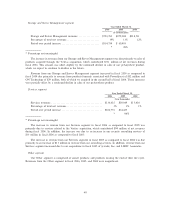

As of March 31, 2006, we had a restructuring reserve of $30 million, of which $20 million was included in

Other accrued expenses in the Consolidated Balance Sheets and $10 million was included in Other long-term

liabilities in the Consolidated Balance Sheets. The restructuring reserve consists of $9 million related to a

restructuring reserve assumed from Veritas in connection with the acquisition, $21 million related to

restructuring reserves established in fiscal 2006, and an insignificant amount related to our fiscal 2002

restructuring plan. Restructuring reserves established in fiscal 2006 include $9 million related to our 2006

restructuring plan, $3 million related to restructuring costs as a result of the Veritas acquisition, and $9 million

related to restructuring costs as a result of our other acquisitions.

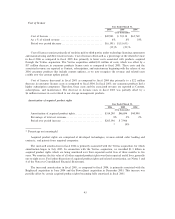

Restructuring expense

In fiscal 2006, we recorded $25 million of restructuring costs, of which $18 million related to severance,

associated benefits, and outplacement services and $7 million related to excess facilities. These restructuring

costs reflect the termination of 446 redundant employees located in the United States, Europe, and Asia

Pacific and the consolidation of certain facilities in Europe and Asia Pacific. In fiscal 2006, we paid

$16 million related to this restructuring reserve. We expect the remainder of the costs to be paid by the end of

fiscal 2018.

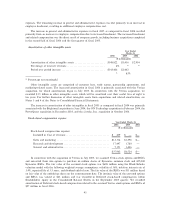

In fiscal 2005, we recorded $3 million of restructuring charges, of which $2 million was for costs of

severance, related benefits, and outplacement services related to the termination of 51 employees located in

47