Symantec 2006 Annual Report Download - page 42

Download and view the complete annual report

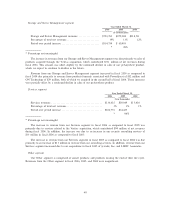

Please find page 42 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

We are required to estimate our income taxes in each federal, state, and international jurisdiction in

which we operate. This process requires that we estimate the current tax exposure as well as assess temporary

differences between the accounting and tax treatment of assets and liabilities, including items such as accruals

and allowances not currently deductible for tax purposes. The income tax effects of the differences we identify

are classified as current or long-term deferred tax assets and liabilities in our Consolidated Balance Sheets.

Our judgments, assumptions, and estimates relative to the current provision for income tax take into account

current tax laws, our interpretation of current tax laws, and possible outcomes of current and future audits

conducted by foreign and domestic tax authorities. Changes in tax laws or our interpretation of tax laws and

the resolution of current and future tax audits could significantly impact the amounts provided for income

taxes in our Consolidated Balance Sheets and Consolidated Statements of Income. We must also assess the

likelihood that deferred tax assets will be realized from future taxable income and, based on this assessment,

establish a valuation allowance, if required. Our determination of our valuation allowance is based upon a

number of assumptions, judgments, and estimates, including forecasted earnings, future taxable income, and

the relative proportions of revenue and income before taxes in the various domestic and international

jurisdictions in which we operate. To the extent we establish a valuation allowance or change the valuation

allowance in a period, we reflect the change with a corresponding increase or decrease to our tax provision in

our Consolidated Statements of Income.

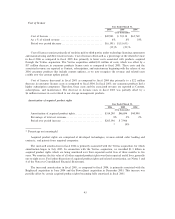

We failed to timely file the final pre-acquisition tax return for Veritas, and as a result, it is uncertain

whether we can claim a lower tax rate on a dividend made from a Veritas foreign subsidiary under the

American Jobs Creation Act of 2004. We are currently petitioning the IRS for relief to allow us to claim the

lower rate of tax. Because we were unable to obtain this relief prior to filing the Veritas tax return in May

2006, we have paid $130 million of additional U.S. taxes. The potential outcomes with respect to our payment

of this amount include:

‚ If we ultimately obtain relief from the IRS on this matter, the $130 million that we paid in May will be

refunded to us and we will use that amount to reestablish our income tax accrual for the Veritas

transfer pricing disputes.

‚ If we ultimately do not receive relief from the IRS on this matter, and we otherwise have an

adjustment arising from the Veritas transfer pricing disputes, then we would only owe additional tax

with regard to such disputes to the extent that such adjustment is in excess of $130 million.

‚ If we ultimately do not receive relief from the IRS on this matter, and we otherwise do not have an

adjustment arising from the Veritas transfer pricing disputes, then (1) we would be required to adjust

the purchase price of Veritas to reflect a reduction in the amount of pre-acquisition tax liabilities

assumed; and (2) we would be required to recognize an equal amount of income tax expense, up to

$130 million.

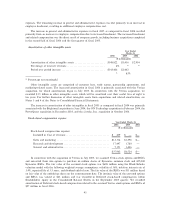

Legal Contingencies

From time to time, we are involved in disputes that arise in the ordinary course of business, and we do not

expect this trend to change in the future. We are currently involved in legal proceedings as discussed in

Note 14 of the Notes to Consolidated Financial Statements, as well as other legal matters.

When the likelihood of the incurrence of costs related to our legal proceedings is probable and

management has the ability to estimate such costs, we provide for estimates of external legal fees and any

probable losses through charges to our Consolidated Statements of Income. These estimates have been based

on our assessment of the facts and circumstances at each balance sheet date and are subject to change based

upon new information and intervening events.

Prior to our acquisition of Veritas, Veritas had been in discussions with the staff of the SEC regarding the

SEC's review of certain matters, as described in Note 14 of the Notes to Consolidated Financial Statements,

and based on communications with the staff, Veritas expected these discussions to result in a settlement with

the SEC in which we would be required to pay a $30 million penalty. As part of our accounting for the

36