Symantec 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

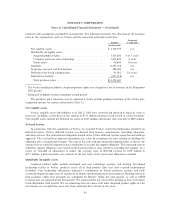

Customer contracts and relationships represent existing contracts that relate primarily to underlying

customer relationships. We are amortizing the fair values of these assets to Operating expenses in the

Consolidated Statements of Income on a straight-line basis over an average estimated life of eight years.

Trade names relate to the Veritas product names that will continue in use. We are amortizing the fair

values of these assets to Operating expenses in the Consolidated Statements of Income on a straight-line basis

over an estimated life of ten years.

Goodwill

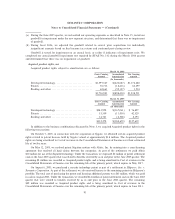

Approximately $8.6 billion of the purchase price has been allocated to goodwill. Goodwill represents the

excess of the purchase price over the fair value of the underlying net tangible and intangible assets. The

goodwill was attributed to the premium paid for the opportunity to expand and better serve the addressable

market and achieve greater long-term growth opportunities than either company had operating alone.

Management believes that the combined company will be better positioned to deliver security and availability

solutions across all platforms, from the desktop to the data center, to customers ranging from consumers and

small businesses to large organizations and service providers. Goodwill recorded as a result of this acquisition

is not deductible for tax purposes.

In accordance with SFAS No. 142, goodwill will not be amortized but instead will be tested for

impairment at least annually (more frequently if certain indicators are present). In the event that

management determines that the value of goodwill has become impaired, we would incur an accounting

charge for the amount of impairment during the fiscal quarter in which the determination is made.

In-process research and development (IPR&D)

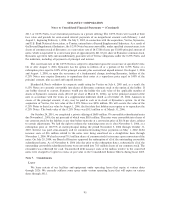

We wrote off acquired IPR&D totaling $284 million in connection with our acquisition of Veritas. The

IPR&D was written off because the acquired technologies had not reached technological feasibility and had

no alternative uses. Technological feasibility is defined as being equivalent to completion of a beta-phase

working prototype in which there is no remaining risk relating to the development. At the time of the

acquisition, Veritas was developing new products in multiple product areas that qualify as IPR&D. These

efforts included NetBackup 6.1, Backup Exec 11.0, Server Management 5.0, and various other projects. At

the time of the acquisition, it was estimated that these IPR&D efforts would be completed over the following

12 to 18 months at an estimated total cost of $120 million. As of March 31, 2006, the development efforts

were continuing on schedule and within expected costs.

The value assigned to IPR&D was determined by estimating costs to develop the purchased IPR&D into

commercially viable products, estimating the resulting net cash flows from the projects when completed, and

discounting the net cash flows to their present value. The revenue estimates used in the net cash flow forecasts

were based on estimates of relevant market sizes and growth factors, expected trends in technology, and the

nature and expected timing of new product introductions by Veritas and its competitors.

The rate utilized to discount the net cash flows to their present value was based on Veritas' weighted

average cost of capital. The weighted average cost of capital was adjusted to reflect the difficulties and

uncertainties in completing each project and thereby achieving technological feasibility, the percentage of

completion of each project, anticipated market acceptance and penetration, market growth rates, and risks

related to the impact of potential changes in future target markets. Based on these factors, a discount rate of

13.5% was deemed appropriate for valuing the IPR&D.

The estimates used in valuing IPR&D were based upon assumptions believed to be reasonable but which

are inherently uncertain and unpredictable. Assumptions may be incomplete or inaccurate, and unanticipated

events and circumstances may occur.

86