Symantec 2006 Annual Report Download - page 4

Download and view the complete annual report

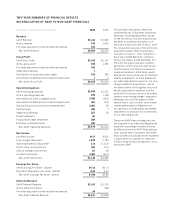

Please find page 4 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FINANCIAL ACHIEVEMENT

We achieved record fi nancial results in fi scal

2006

, albeit, slightly below our initial expecta-

tions. Our non-

GAAP

revenue

¹

grew

8

% to

$ 5.0

billion, while non-

GAAP

earnings per share

¹

grew

16 %

to

$ 1.00

. Our non-

GAAP

deferred revenue

¹

grew

18 %

to over

$ 2.2

billion. In

addition, we generated

$ 1.6

billion in pro forma combined cash fl ow from operating activities ².

We ended the year with

$ 2.9

billion in cash, cash equivalents and short-term investments.

The board and I believe that repurchasing stock is an excellent way to enhance shareholder

value, and during fi scal

2006

we invested approximately

$ 3.6

billion buying back nearly

175 million shares of our common stock. In January the board authorized an additional

$ 1

billion of stock repurchases. And, in June the board authorized another

$ 1.5

billion.

INNOVATION: DRIVING GROWTH

Symantec has always grown by combining strategic acquisitions with strong internal

technology and product development. In fi scal

2006

we executed on this strategy again and

completed six acquisitions in addition to completing our merger with Veritas. And our

R&D

teams generated more than

100

new products and services across all of our categories,

while our consumer products group shipped nearly

23

million boxes around the world.

To ensure that we continue to offer industry-leading products and services, we intend to

invest approximately

15

percent of annual gross revenue into

R&D

— protecting our custom-

ers from tomorrow’s challenges and enabling them to take advantage of tomorrow’s

opportunities. In addition, as we have for the past several years, we will look to augment

our

R&D

efforts by acquiring leading technologies in adjacent markets.

ESTABLISHING AND LEVERAGING A STRONG MARKET POSITION

Enterprises need to keep their infrastructure up and running

24

×

7

×

365

. They need to

enable access to information anytime, anywhere. That means that critical business systems

must be up and running all the time. It starts with the basics of protection. Sustaining

the continuous availability of information, systems, and applications requires businesses

to protect their entire data center infrastructure — from client to storage to servers.

Symantec pioneered the idea of protection. We are the leader in creating and deploying

new data security and availability technologies. Currently, we have numerous development

projects underway that we believe will extend that leadership position, particularly in

the enterprise market.

As we pursue these projects, we will focus on the critical areas of message management,

IT

policy compliance, and endpoint compliance. Messaging systems, such as email, are

fundamental to business operations, and managing the messaging environment requires

real-time protection at all layers of the infrastructure. We are also introducing innova-

tive solutions to help our customers in the areas of

IT

policy compliance and endpoint

compliance — areas that we believe will be important business drivers as organizations

increasingly recognize the need to demonstrate compliance with internal policies and

external regulations.

2

1 Non-GAAP results are

reconciled to GAAP results

on the inside front cover.

2 Pro forma combined

cash fl ow from operating

activities includes

Symantec’s fi scal 2006

cash fl ow from oper-

ations of $ 1.5 billion and

Veritas’ June quarter

2005 cash fl ow from

operations of $ 106 million.