Symantec 2006 Annual Report Download - page 64

Download and view the complete annual report

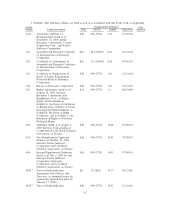

Please find page 64 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(e) Per share amounts reflect the two-for-one stock split effected as a stock dividend, which occurred on

November 30, 2004.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Not applicable.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

Our Chief Executive Officer and our Chief Financial Officer have concluded, based on an evaluation of

the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of

the Securities Exchange Act of 1934, as amended) by our management, with the participation of our Chief

Executive Officer and our Chief Financial Officer, that, as a result of the material weakness described below,

such disclosure controls and procedures were not effective as of the end of the period covered by this report.

(b) Management's Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial

reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Securities Exchange Act of 1934, as amended)

for Symantec. Our management, with the participation of our Chief Executive Officer and our Chief Financial

Officer, has conducted an evaluation of the effectiveness of our internal control over financial reporting as of

March 31, 2006, based on criteria established in Internal Control Ì Integrated Framework issued by the

Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Based on its evaluation, our management has identified a material weakness in internal control over

financial reporting related to accounting for income taxes as of March 31, 2006. A material weakness is a

significant deficiency, as defined in Public Company Accounting Oversight Board Auditing Standard No. 2, or

a combination of significant deficiencies, that results in more than a remote likelihood that a material

misstatement of a company's annual or interim financial statements would not be prevented or detected by

company personnel in the normal course of performing their assigned functions.

Management has determined that we had insufficient personnel resources with adequate expertise to

properly manage the increased volume and complexity of income tax matters associated with the acquisition of

Veritas Software Corporation. This lack of resources resulted in inadequate levels of supervision and review

related to the our IRS filings and our accounting for income taxes. This material weakness resulted in our

failure to follow established policies and procedures designed to ensure timely income tax filings. Specifically,

we did not complete the timely filing of an extension request with the IRS for the final pre-acquisition income

tax return for Veritas and, accordingly, did not secure certain income tax related elections. In addition, this

material weakness resulted in errors in our annual accounting for income taxes. These errors in accounting

were corrected prior to the issuance of our 2006 consolidated financial statements. The aforementioned

material weakness results in more than a remote likelihood that a material misstatement of our annual or

interim financial statements, due to a failure to complete income tax filings consistent with management's

intentions, and due to errors in accounting for income taxes, would not be prevented or detected.

Because of this material weakness, management has concluded Symantec did not maintain effective

internal control over financial reporting as of March 31, 2006, based on criteria established in Internal

Control Ì Integrated Framework issued by the COSO.

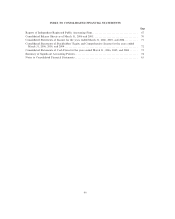

Our independent registered public accounting firm, KPMG LLP, has audited management's assessment

of the effectiveness of Symantec's internal control over financial reporting and has issued an audit report

thereon, which is included in Part IV, Item 15 of this annual report.

58