Symantec 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

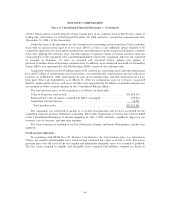

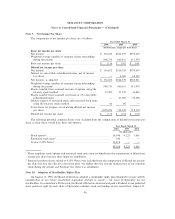

Fiscal 2004 Acquisitions

During fiscal 2004, we acquired two public and two privately-held companies for a total of $311 million in

cash, including acquisition-related expenses resulting from financial advisory, legal, and accounting services,

duplicate sites, and severance costs. An insignificant amount of acquisition-related expenses remains as an

accrual as of March 31, 2006. We recorded goodwill in connection with each of these acquisitions. In each

acquisition, goodwill resulted primarily from our expectation of synergies from the integration of the acquired

company's technology with our technology and the acquired company's access to our global distribution

network. In addition, each acquired company provided a knowledgeable and experienced workforce. The

results of operations of the acquired companies have been included in our operations from the dates of

acquisition. ON Technology Corp. and PowerQuest, Inc. are included in our Storage and Server Management

segment, and SafeWeb, Inc. and Nexland, Inc. are included in our Enterprise Security segment. Details of the

purchase price allocations related to our fiscal 2004 acquisitions are included in the table below. Our fiscal

2004 acquisitions were considered insignificant for pro forma financial disclosure, both individually and in the

aggregate.

Nexland SafeWeb PowerQuest ON Technology Total

(In thousands)

Acquisition dateÏÏÏÏÏÏÏÏ July 17, 2003 Oct 15, 2003 Dec 5, 2003 Feb 13, 2004

Net tangible assets

(liabilities) ÏÏÏÏÏÏÏÏÏÏ $ (2,507) $ 366 $ 16,125 $ 14,420 $ 28,404

Acquired product rightsÏÏ 1,000 1,000 19,600 7,410 29,010

Other intangible assets ÏÏ 60 Ì 2,400 5,660 8,120

IPR&D ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,000 Ì 1,600 1,110 3,710

Goodwill ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,791 21,603 114,352 70,463 227,209

Deferred tax asset, net ÏÏ 547 3,600 270 10,293 14,710

Total purchase price ÏÏÏÏ $ 20,891 $ 26,569 $ 154,347 $ 109,356 $311,163

The amounts allocated to Acquired product rights are being amortized to Cost of revenues in the

Consolidated Statements of Income over their estimated lives of four to five years. The amounts allocated to

Other intangible assets are being amortized to Operating expenses in the Consolidated Statements of Income

over their estimated lives of two to seven years. The IPR&D was written off on the acquisition date.

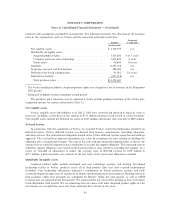

Note 4. Goodwill, Acquired Product Rights, and Other Intangible Assets

Goodwill

In accordance with SFAS No. 142, we allocate goodwill to our reporting units, which are the same as our

operating segments. Goodwill is allocated as follows:

Storage &

Enterprise Server Data Consumer

Security Management Protection Services Products Total

(In thousands)

Balance as of March 31, 2005 $1,017,622 $ 193,192 $ Ì $ 149,183 $ 5,216 $ 1,365,213

Goodwill acquired through the

Veritas acquisitionÏÏÏÏÏÏÏÏÏ Ì 3,439,107 4,986,706 171,955 Ì 8,597,768

Goodwill acquired through

other acquisitionsÏÏÏÏÏÏÏÏÏÏ 287,280 31,748 Ì Ì 62,737 381,765

Operating segment

reclassification(a) ÏÏÏÏÏÏÏÏÏ 116,543 Ì Ì (116,543) Ì Ì

Goodwill adjustments(b) ÏÏÏÏÏ (10,584) 405 Ì (3,522) Ì (13,701)

Balance as of March 31, 2006 $1,410,861 $3,664,452 $4,986,706 $ 201,073 $67,953 $10,331,045

90