Symantec 2006 Annual Report Download - page 59

Download and view the complete annual report

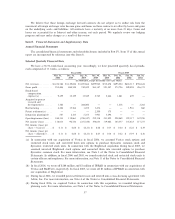

Please find page 59 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net cash used for investing activities in fiscal 2005 was primarily the result of payments for business

acquisitions of $424 million and net purchases of available-for-sale securities of $143 million.

Net cash used for investing activities in fiscal 2004 was primarily the result of net purchases of available-

for-sale securities of $332 million, payments for business acquisitions of $287 million, and capital expenditures

of $111 million.

We expect to continue our investing activities, including investments in available-for-sale securities.

Furthermore, cash reserves may be used for strategic acquisitions of software companies or technologies that

are complementary to our business.

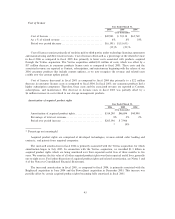

Financing Activities

We have operated a stock repurchase program since 2001. On March 28, 2005, the Board of Directors

increased the dollar amount of authorized stock repurchases by $3 billion, which became effective upon

completion of the Veritas acquisition on July 2, 2005. We commenced repurchases under the $3 billion

authorization on August 2, 2005 and as of December 31, 2005 all authorized repurchases, including

$474 million from prior authorizations, were completed.

On January 31, 2006, the Board, through one of its committees, authorized the repurchase of $1 billion of

Symantec common stock, without a scheduled expiration date. In connection with this stock repurchase

authorization, we entered into Rule 10b5-1 trading plans intended to facilitate stock repurchases of

$125 million per quarter during fiscal 2007. We used $154 million of the authorized amount to repurchase

shares in the open market in the March 2006 quarter and we intend to use the remaining amount to make

stock repurchases under Rule 10b5-1 trading plans and opportunistically in fiscal 2007.

In fiscal 2006, we repurchased 174 million shares at prices ranging from $15.83 to $23.85 per share for an

aggregate amount of $3.6 billion. In fiscal 2005, we repurchased eight million shares at prices ranging from

$21.05 to $30.77 per share for an aggregate amount of $192 million. In fiscal 2004, we repurchased

three million shares at prices ranging from $19.52 to $20.82 per share for an aggregate amount of $60 million.

As of March 31, 2006, $846 million remained authorized for future repurchases. For further information

regarding stock repurchases, see Item 5, Market for Registrant's Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities of this annual report.

In fiscal 2006, 2005, and 2004, we received net proceeds of $210 million, $160 million, and $189 million,

respectively, from the sale of our common stock through employee benefit plans.

In fiscal 2006, we repaid the entire balance of a short-term loan with a principal amount of

EURO 411 million that we assumed in connection with our acquisition of Veritas.

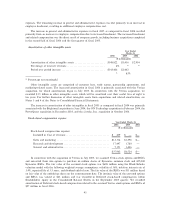

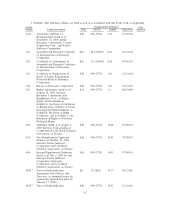

Contractual Obligations

The contractual obligations presented in the table below represent our estimates of future payments under

fixed contractual obligations and commitments. Changes in our business needs, cancellation provisions,

interest rates, and other factors may result in actual payments differing from these estimates. We cannot

provide certainty regarding the timing and amounts of payments related to the contractual obligations set forth

53