Symantec 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

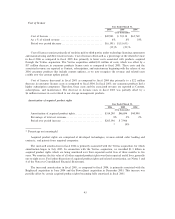

Patent settlement

On May 12, 2005, we resolved patent litigation matters with Altiris, Inc. by entering into a cross-licensing

agreement that resolved all legal claims between the companies. As part of the settlement, we paid Altiris

$10 million for use of the disputed technology. Under the transaction, we expensed $2 million of patent

settlement costs in the June 2005 quarter that was related to benefits received in and prior to the June 2005

quarter. The remaining $8 million was recorded as Acquired product rights in the Consolidated Balance

Sheets and is being amortized to Cost of revenues in the Consolidated Statements of Income over the

remaining life of the primary patent, which expires in May 2017.

On August 6, 2003, we purchased a security technology patent as part of a settlement in Hilgraeve, Inc. v.

Symantec Corporation. As part of the settlement, we also received licenses to the remaining patents in

Hilgraeve's portfolio. The total cost of purchasing the patent and licensing additional patents was $63 million,

which was paid in cash in August 2003. Under the transaction, we recorded $14 million of patent settlement

costs in the June 2003 quarter that was related to benefits received by us in and prior to the June 2003 quarter.

The remaining $49 million was recorded as Acquired product rights in the Consolidated Balance Sheets and is

being amortized to Cost of revenues in the Consolidated Statements of Income over the remaining life of the

primary patent, which expires in June 2011.

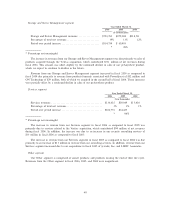

Non-operating Income and Expense

Year Ended March 31,

2006 2005 2004

($ in thousands)

Interest and other income, net ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $106,754 $ 51,185 $ 40,254

Interest expenseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (17,996) (12,323) (21,164)

Income, net of expense, from sale of technologies and

product lines ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 9,547

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 88,758 $ 38,862 $ 28,637

Percentage of total net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2% 2% 2%

Period over period increase ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 49,896 $ 10,225

* 36%

* Percentage not meaningful

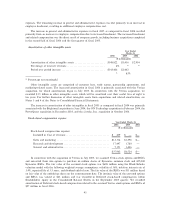

The increase in Interest and other income, net in fiscal 2006 as compared to fiscal 2005 was due primarily

to a higher average investment balance, due to the cash acquired through the Veritas acquisition, and higher

average interest rates. The increase in Interest and other income, net in fiscal 2005 as compared to fiscal 2004

was due to a higher average investment balance and higher average interest rates.

Interest expense in fiscal 2006 was due primarily to the interest and accretion related to the 0.25% con-

vertible subordinated notes that were assumed in connection with the acquisition of Veritas. In August 2003,

Veritas issued $520 million of 0.25% convertible subordinated notes due August 1, 2013. For further

discussion of the 0.25% convertible subordinated notes, see Note 6 of the Notes to Consolidated Financial

Statements.

Interest expense in fiscal 2005 and 2004 was primarily related to our $600 million 3% convertible

subordinated notes issued in October 2001. In November 2004, substantially all of the outstanding convertible

subordinated notes were converted into 70.3 million shares of our common stock and the remainder was

redeemed for cash.

Income, net of expense, from sale of technologies and product lines during fiscal 2004 primarily related to

royalty payments received in connection with the licensing of substantially all of the ACT! product line

technology. In December 2003, Interact Commerce Corporation purchased this technology from us.

49