Symantec 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

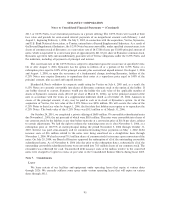

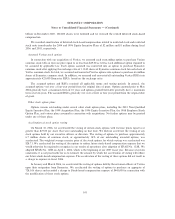

2013, or 0.25% Notes, to several initial purchasers in a private offering. The 0.25% Notes were issued at their

face value and provide for semi-annual interest payments of an insignificant amount each February 1 and

August 1, beginning February 1, 2004. On July 2, 2005, in connection with the acquisition, Veritas, Symantec,

and U.S. Bank National Association, as Trustee, entered into a Second Supplemental Indenture. As a result of

the Second Supplemental Indenture, the 0.25% Notes became convertible, under specified circumstances, into

shares of common stock of Symantec at a conversion rate of 24.37288 shares per $1,000 principal amount of

notes, which is equivalent to a conversion price of approximately $41.03 per share of Symantec common stock.

Symantec agreed to fully and unconditionally guarantee all of Veritas' obligations under the 0.25% Notes and

the indenture, including all payments of principal and interest.

The conversion rate of the 0.25% Notes is subject to adjustment upon the occurrence of specified events.

On or after August 5, 2006, Symantec has the option to redeem all or a portion of the 0.25% Notes at a

redemption price equal to 100% of the principal amount, plus accrued and unpaid interest. On August 1, 2006

and August 1, 2008, or upon the occurrence of a fundamental change involving Symantec, holders of the

0.25% Notes may require Symantec to repurchase their notes at a repurchase price equal to 100% of the

principal amount, plus accrued and unpaid interest.

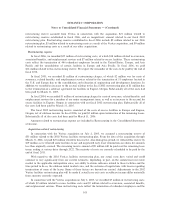

Standard & Poor's withdrew its corporate credit rating for Veritas on July 6, 2005 and, as a result, the

0.25% Notes are currently convertible into shares of Symantec common stock at the option of the holder. If

any holder elected to convert, Symantec would pay the holder the cash value of the applicable number of

shares of Symantec common stock ($16.83 per share at March 31, 2006), up to the principal amount of the

note in accordance with the terms of a supplemental indenture dated as of October 25, 2004. Amounts in

excess of the principal amount, if any, may be paid in cash or in stock at Symantec's option. As of the

acquisition of Veritas, the fair value of the 0.25% Notes was $496 million. We will accrete the value of the

0.25% Notes to their face value by August 1, 2006, the first date that holders may require us to repurchase the

0.25% Notes. The book value of the 0.25% Notes was $513 million as of March 31, 2006.

On October 24, 2001, we completed a private offering of $600 million 3% convertible subordinated notes

due November 1, 2006, the net proceeds of which were $585 million. The notes were convertible into shares of

our common stock by the holders at any time before maturity at a conversion price of $8.54 per share, subject

to certain adjustments. We had the right to redeem the remaining notes on or after November 5, 2004, at a

redemption price of 100.75% of stated principal during the period November 5, 2004 through October 31,

2005. Interest was paid semi-annually and we commenced making these payments on May 1, 2002. Debt

issuance costs of $16 million related to the notes were being amortized on a straight-line basis through

November 1, 2006. We had reserved 70.3 million shares of common stock for issuance upon conversion of the

notes. On July 20, 2004, our Board of Directors approved the redemption of all of the outstanding convertible

subordinated notes. As of November 4, 2004 (the day prior to the redemption date), substantially all of the

outstanding convertible subordinated notes were converted into 70.3 million shares of our common stock. The

remainder was redeemed for cash. Unamortized debt issuance costs of $6 million relative to the converted

notes were charged to Capital in excess of par value in the Consolidated Balance Sheets during fiscal 2005.

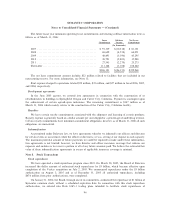

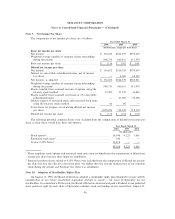

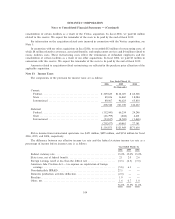

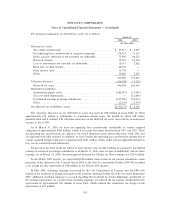

Note 7. Commitments

Leases

We lease certain of our facilities and equipment under operating leases that expire at various dates

through 2026. We currently sublease some space under various operating leases that will expire on various

dates through 2012.

95