Symantec 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sell annual content update subscriptions directly to end-users primarily via the Internet. As a result of

increases in future subscription pricing for the 2006 versions of our consumer products that include content

updates, we recognize revenue for these products ratably over the term of the subscription upon sell-through to

end users. For most other consumer products, we recognize package product revenue on distributor and

reseller channel inventory that is not in excess of specified inventory levels in these channels. We offer the

right of return of our products under various policies and programs with our distributors, resellers, and end-

user customers. We estimate and record reserves for product returns as an offset to revenue. We fully reserve

for obsolete products in the distribution channel as an offset to revenue.

For our Enterprise Security, Data Protection, and Storage and Server Management segments, we

generally recognize revenue from licensing of software products through our indirect sales channel upon sell-

through or with evidence of an end user. For licensing of our software to original equipment manufacturers, or

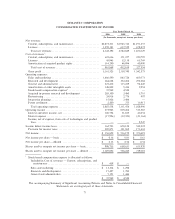

OEMs, royalty revenue is recognized when the OEM reports the sale of the software products to an end-user

customer, generally on a quarterly basis. In addition to license royalties, some OEMs pay an annual flat fee

and/or support royalties for the right to sell maintenance and technical support to the end user. We recognize

revenue from OEM support royalties and fees ratably over the term of the support agreement.

We offer channel and end-user rebates for our products. Our estimated reserves for channel volume

incentive rebates are based on distributors' and resellers' actual performance against the terms and conditions

of volume incentive rebate programs, which are typically entered into quarterly. Our reserves for end-user

rebates are estimated based on the terms and conditions of the promotional program, actual sales during the

promotion, amount of actual redemptions received, historical redemption trends by product and by type of

promotional program, and the value of the rebate. We estimate and record reserves for channel and end-user

rebates as an offset to revenue. For 2006 consumer products that include content updates, rebates are recorded

as a ratable offset to revenue over the term of the subscription.

Cash Equivalents and Short-Term Investments

We classify our cash equivalents and short-term investments in accordance with SFAS No. 115,

Accounting for Certain Investments in Debt and Equity Securities. We consider investments in instruments

purchased with an original maturity of 90 days or less to be cash equivalents. We classify our short-term

investments as available-for-sale, and short-term investments consist of marketable debt or equity securities

with original maturities in excess of 90 days. Our short-term investments do not include equity investments in

privately held companies. Our short-term investments are reported at fair value with unrealized gains and

losses, net of tax, included in Accumulated other comprehensive income within Stockholders' equity in the

Consolidated Balance Sheets. The amortization of premiums and discounts on the investments, realized gains

and losses, and declines in value judged to be other-than-temporary on available-for-sale securities are

included in Interest and other income, net in the Consolidated Statements of Income. We use the specific

identification method to determine cost in calculating realized gains and losses upon sale of short-term

investments.

Trade Accounts Receivable

Trade accounts receivable are recorded at the invoiced amount and are not interest bearing. We maintain

an allowance for doubtful accounts to reserve for potentially uncollectible trade receivables. Additions to the

allowance for doubtful accounts are recorded as operating expenses. We review our trade receivables by aging

category to identify specific customers with known disputes or collectibility issues. We exercise judgment

when determining the adequacy of these reserves as we evaluate historical bad debt trends, general economic

conditions in the U.S. and internationally, and changes in customer financial conditions. We also offset

deferred revenue against accounts receivable when channel inventories are in excess of specified levels and for

transactions where collection of a receivable is not considered probable.

Equity Investments

We have equity investments in privately held companies for business and strategic purposes. These

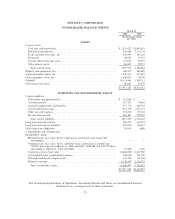

investments are included in Other long-term assets in the Consolidated Balance Sheets and are accounted for

under the cost method as we do not have significant influence over these investees. Under the cost method, the

76